The Ultimate Digital Banking Engagement Playbook

How to gain, retain, and monetise customers through meaningful engagement.

This Playbook explores 3 key steps

1. Turn your data into value

Data is the first pillar of meaningful customer engagement and one of your key competitive advantages.

2. Hyper-personalise the digital banking experience

If people feel their bank really knows them and their financial situation, they’re less likely to look elsewhere and start afresh with a new provider.

3. Harness gamification to build habits

Helping customers change their behaviour and develop positive routines is the third pillar of meaningful digital engagement.

Profit from Customer Value

In banking, customers are your most important asset. From growing revenues to enhancing competitiveness, every aspect of your financial success depends on the ability to attract and retain customers, as well as drive their adoption of new products or services.

Meaningful engagement lies at the heart of a successful Digital Bank

Engagement is a simple concept: when customers spend more time using your services, they’ll be more loyal and more ready to explore other products you recommend. Meaningful engagement goes even deeper, however, transforming your bank from a distant transactional institution into a truly indispensable customer guide. What makes engagement meaningful?We believe it’s when you’re helping customers achieve valued outcomes that matter to them.

The necessity for digital innovation

To profit from generating customer value, you must embrace digital innovation to move fast and get things right.

According to Deloitte, a poor digital experience is now the number one reason for customer churn, while Accenture2 also points to a superior digital experience as the biggest driver of customer loyalty and retention. In this environment, your app needs to be among the handful that customers want to use every day.

As the foundation of a great digital experience, your data needs to be delivering value for both customers and your bank. You’ve likely invested considerable time and resources into managing your data already, but is it enabling key business outcomes? If not, you can’t afford to be left behind.

Leaders in this space are already unlocking digital features and functionality that unleash enormous possibilities for customer engagement. You’re not just competing with other banks in this race either.

Digital natives—tech giants, social media companies, niche fintech players, and more—are muscling into the sector. EY3 has found that more than a quarter (27%) of global customers now have relationships with such non-traditional competitors. Digital engagement is the breadand butter of many of these companies and they already have the skills and technology stacks to build exceptional customer experiences.

At the same time, it’s never been easier for customers to switch. Industry regulation, combined with a push towards standard features and functionality, has also left banking services increasingly commoditised and homogenous. In this environment, you need to stand up and stand out.

Who we are

As experts in digital engagement, we can help.

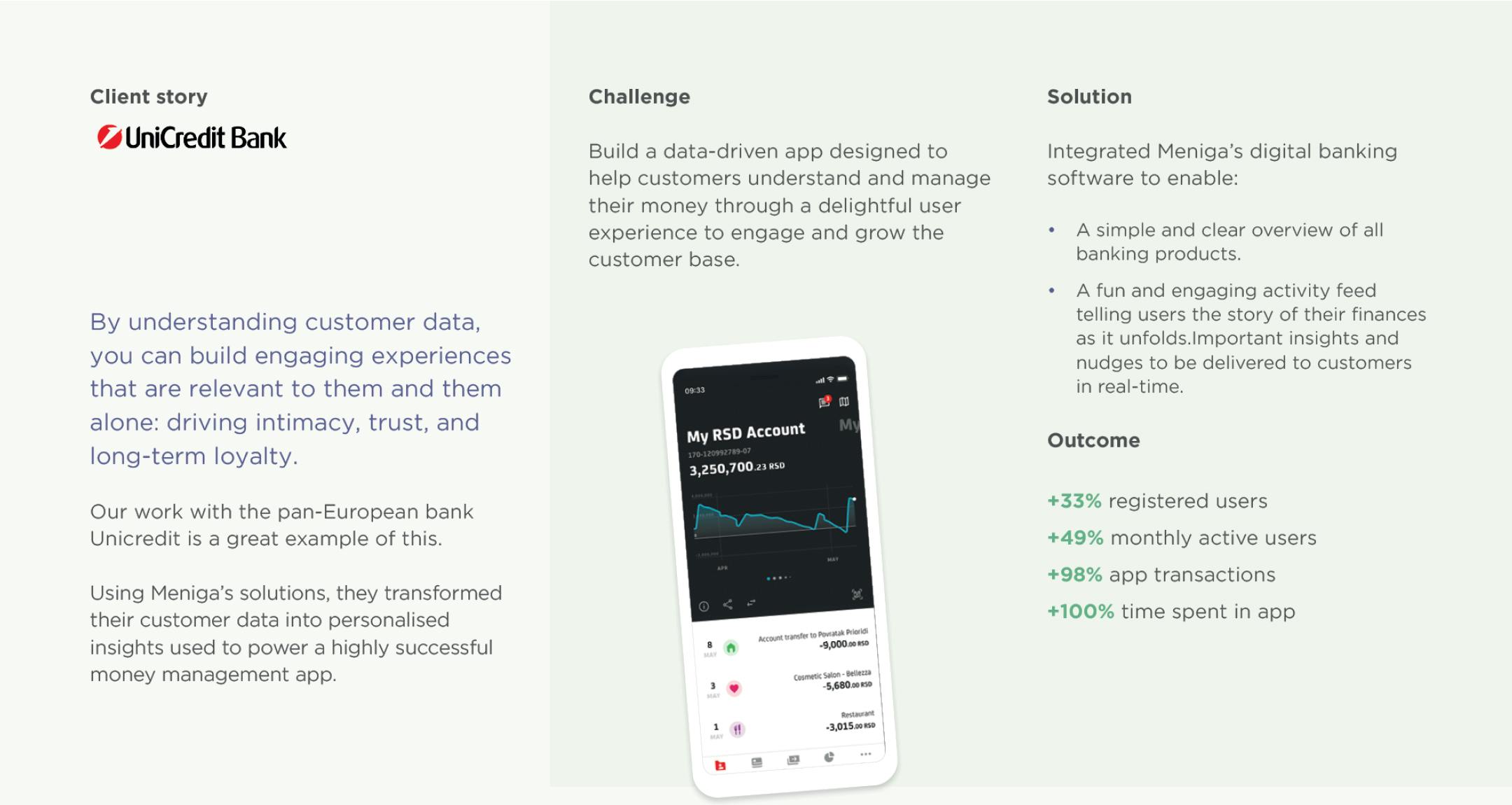

We work with more than 170 banks in over 30 countries, our solutions support 100 million digital banking users, and we process over 15 billion transactions a year. With a deep understanding of behavioural psychology and a B2C testing platform used by 40% of the Icelandic population, we know what works for banking customers.

In this playbook, we’ll explore the three pillars of digital customer engagement—data, personalisation, and habitualisation—to show exactly what it takes to drive meaningful, outcome-centered services.

We’ve also surveyed banks and their customers worldwide to gauge where they are in this journey and how they’re thinking about the future. Whether your focus is attracting new customers, retaining those you have, cross-selling products, or increasing the cross-selling products, or increasing the time spent in your app, read on to see how meaningful engagement can move the needle on your business goals.

STEP 1: Turn your data into value

Data is the first pillar of meaningful customer engagement and one of your key competitive advantages.

You’re sitting on a goldmine of knowledge about customers that can power an enticing digital banking experience and deliver quantifiable business success.

Financial transactions give you an extraordinary level of insight into someone’s life—from basics like where they live and work, right through to their particular spending and saving habits. These insights can be truly granular.

For instance, you can see that a customer who buys whole foods, pays for a gym membership, and takes yoga classes is a health and well-being enthusiast. Such insights mean you’re ideally placed to drive positive outcomes for your customers and your business. You can deepen engagement by helping customers reach their goals—not only in financial terms like spending, saving, or investing, but also beyond into areas like health, sustainability, and more. To harness customer insights, you need the right data first and foremost. It must be accurate, timely, high-quality, and well-managed—combining account information, transactions, Open Banking data, and third-party sources.

You’re likely among the 71% of banks already investing in consolidating, enriching, and securing customer data in your back-end systems. Some banks now spend more than 10% of their revenue4 on digital innovation; in fact, one global player just increased its annual technology budget to $12 billion5.

But is this mountain of time and money enabling you to deliver against business targets, like increasing engagement, digital channel sales or customer lifetime value? Not unless you’re driving digital innovation and applying data at scale to find insights and offer advice that helps customers achieve outcomes that matter to them.

Meaningful engagement can only happen when you have the ability to pull deep insights from your data lake that will grab a customer’s attention and capture their imagination.

To do the same, you must be able to keep up with the breakneck pace of data—reacting to new developments in real-time as customers spend, save, or invest.

Equally, you need to be able to make long-term predictions about customer behaviour that helps them either avoid problems or achieve future goals.

It’s these capabilities that will transform you in the minds of customers from a distant transactional institution into an indispensable financial advisor on the road ahead. Almost two-thirds of customers we spoke to (60%) said they would like personalised advice to help with their finances, while even more (64%) were keen for their digital bank to suggest the right products for them.

By harnessing data-led insights, you can help customers fundamentally change their lives for the better in ways large and small.

From financial wellness to personal fitness, the outcomes you can help customers achieve are infinite.

Financial wellness

Highlight that concert tickets made up 10% of this month’s spending and offer a customer voucher codes to reduce the cost next time.

Personal fitness

Inform a customer they’ve spent 30% more on fast food this month than normal and encourage them to spend less next month.

Mental wellbeing

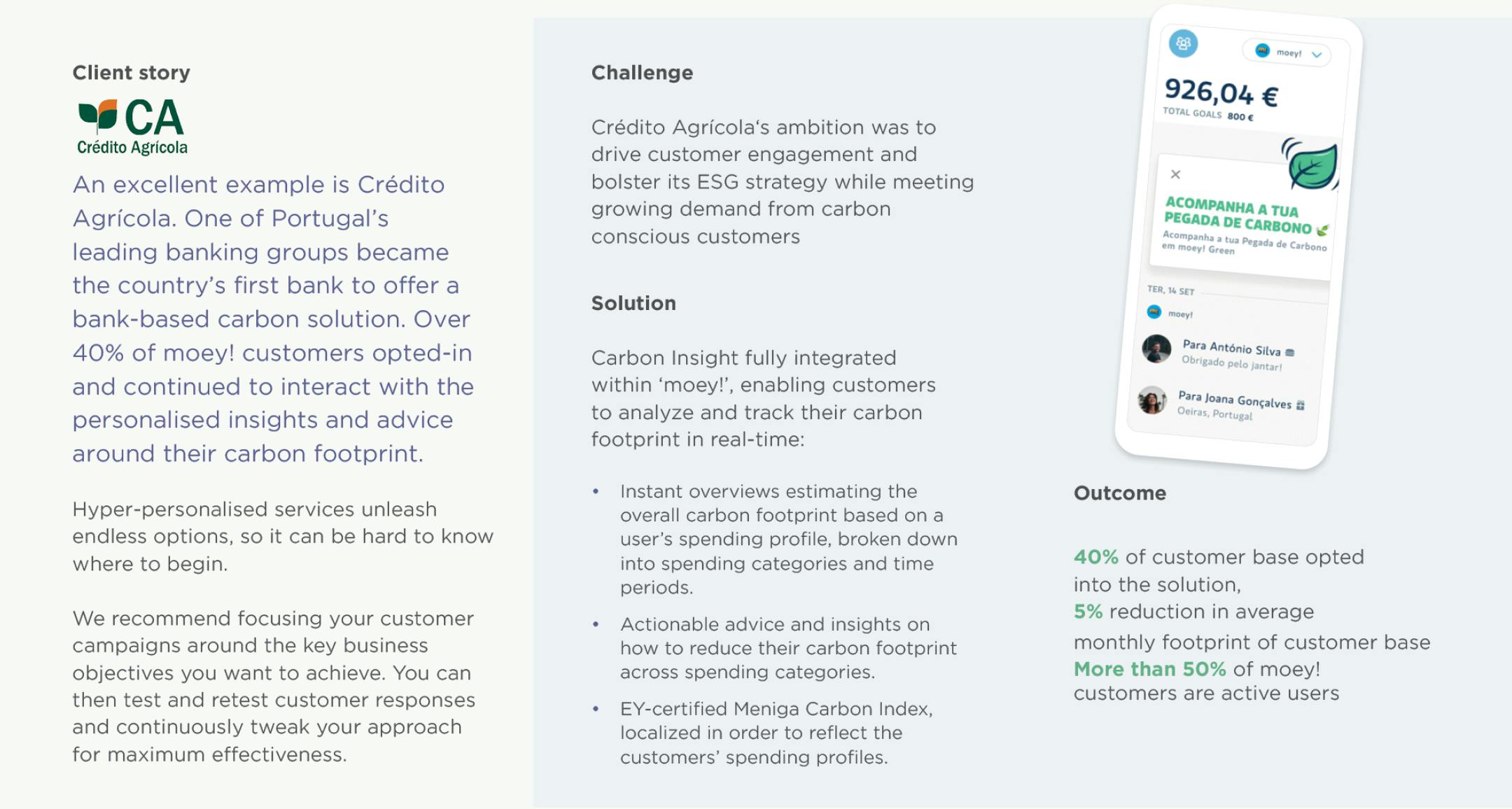

Instill a sense of achievement by calculating the carbon footprint of purchased flights and helping a customer offset it to combat climate change.

STEP 2: Hyper-personalise the digital banking experience

Today, digital banking services are almost interchangeable. If you’ve seen one banking app, you’ve seen them all—the features and functionality will be very similar, if not identical.

In this environment, our next pillar of engagement—hyper-personalised services—lets you drive differentiation based on the reality that every customer is unique.

While personalisation might be as simple as letting a customer know they’ve spent 10% more this month, hyper-personalisation is precise, context-specific, and goes much further. For instance, you might identify that a customer’s usual spending will take them $250 beyond their overdraft this month and offer credit options to help. In the post-pandemic world, personalised offerings like this will be particularly valued, with many customers hungry for more financial advice and support.

With the ability to share information and offers relevant to one customer and to them alone, you can drive intimacy, trust, and long-term loyalty - which can lead to increases in NPS and number of active users.

Additionally, by supporting hyper-personalisation with an understanding of psychology and different personality types you can make services even stickier.

Four-in-five bankers we surveyed (79%) agreed that it’s important for their customers to receive hyper-personalised insights, advice, and services—yet 25% also said they do not have the skills to use psychology to drive customer engagement7.

The time and money you invest into understanding customers will pay dividends; three-quarters of bankers (76%) agree that offering hyper-personalised services impacts customer monetisation7.

If people feel their bank really knows them and their financial situation, they’re less likely to look elsewhere and start afresh with a new provider. If people feel they’re learning something that will help them improve their lives, they’ll keep coming back for more.

For instance, to drive retention you could focus on the abilityto support customers at majorlife milestones.

Customer data enables you to make predictions about the next stage of someone’s life—such as buying a home, having a child, or retiring. This lets you proactively send tailored advice, insights, or product recommendations at just the right moment, encouraging customers to rely on you as a trusted advisor.

Cross-sell services:

Insight: You’re newly married and spending 20% more on rent than the average couple.

Advice: You could save money by purchasing your first home. Here’s a range of affordable mortgages.

Financial wellness:

Insight: You’ve started a new job and have 30% more disposable income based on your average monthly outgoings.

Advice: Put 10% of your salary into savings or investment options each month to improve your financial security.

Sustainability:

Insight: You’ve started commuting to work by car each day, so you’re spending more on fuel and your carbon footprint is growing.

Advice: Consider green loan options and investment projects, or offset your carbon footprint through certified programs.

STEP 3: Harness gamification to build habits

Helping customers change their behaviour and develop positive routines is the third pillar of meaningful digital engagement.

People are creatures of habit—and that’s a key advantage you need to be harnessing when it comes to attracting, retaining, and maximising value from customers. Almost all of the bankers we surveyed (84%) agreed that reinforcing positive financial habits can impact customer loyalty.

Finding and acquiring customers is expensive, but it’s far less costly to keep them. When customers happily and habitually use your tools to drive positive change in their everyday lives, they’re more loyal and will have your bank top of mind when it comes to any future financial services.

Psychology tells us that rewarding customers is the best way to embed routine and reinforce positive financial habits. These rewards could be anything from specific financial incentives to a general sense of recognition or achievement.

For instance, notifications are one of the key reasons that people are constantly motivated to check on their social media feeds—seeing new likes and shares causes a small hit of dopamine, the “feel-good” hormone. Banks can use the same principles to encourage customers to regularly use an app, for instance by giving them a constantly updated activity feed of hyper-personalised notifications, advice, and offers.

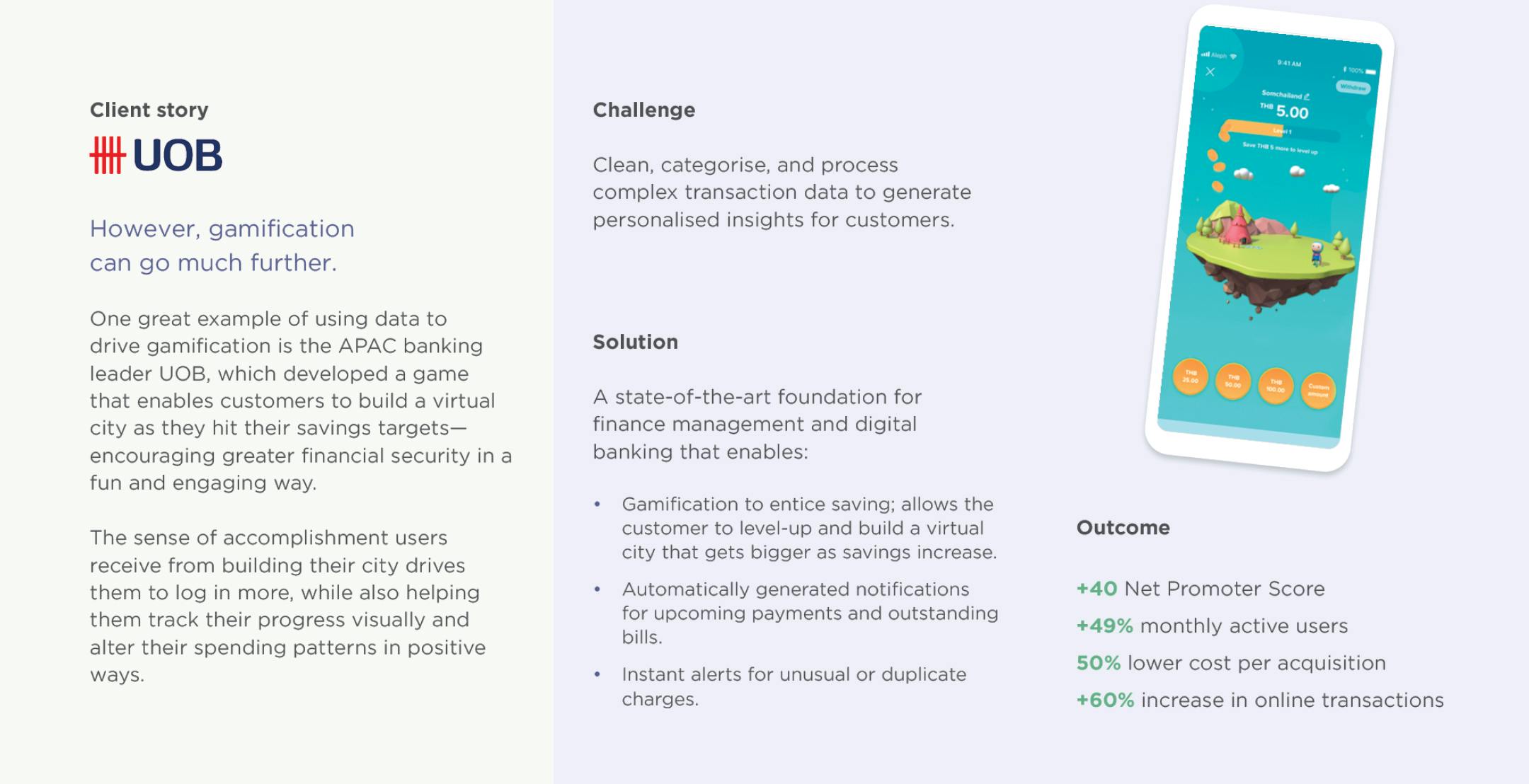

Banks are increasingly embracing true gamification to drive meaningful engagement.

Gamification is a powerful way to create positive psychological associations with your services and build habit-forming loops, that are proven to work. These repeating loops consist of a trigger that calls a customer to take action, which is then rewarded to encourage them to invest more time in the future.

Gamification isn’t only effective at engaging younger people either—it can be tailored to attract any age group you’re trying to target. Let’s run through some examples.

At perhaps the most basic level, you can engage customers in challenges—such as spending less in bars or coffee shops during a set period—and then offer tiered rewards depending on their level of achievement.

You can also find great success by harnessing simple digital features to build positive habits—such as challenging customers to categorise their own transactions and rewarding them with new insights or offers for doing so.

This not only enables customers to better understand and manage their finances, but also allows your app or service to work better for them as time goes by - ultimately leading to increases in key business outcomes like NPS.

Accelerate digital innovation

You’ve seen the benefits of meaningful engagement—and now you’re probably asking ‘what’s the catch?’. If you think enabling these capabilities demands huge infrastructure spending, high-risk projects, or hundreds of new hires, think again.

Accelerating digital innovation and meaningful customer engagement needn’t be risky or cost the Earth.

Our lightweight, modular platform of solutions and specific use cases can be quickly deployed on top of any existing data system to help you innovate at speed.

Regardless of where you are on your digital banking roadmap, we can help you.

From setting the foundations of great digital engagement to taking your offering to the next level with AI-driven personalised advice and gamified experiences in no time.

Don’t let the money you’ve already invested into data management go to waste.

We’ve obsessed over the science behind customer engagement for many years and all our solutions are grounded in behavioural psychology. We understand what works and what doesn’t.

As well as supporting banks worldwide, we also run our own B2C platform used by 40% of the Icelandic population, giving us the perfect testbed for new ideas. Working with us solves the challenge of trying to recruit highly-qualified data analysts for in-house roles in a costly market too. Whether you want a cloud-based SaaS or on-premise deployment, our team will ensure painless technical implementation in the shortest time possible and our low-code solutions are easy for your team to manage and monitor without specialist qualifications.

Ultimately, it’s not a question of whether you can afford to drive digital innovation, but whether you can afford not too. With competitors looking for any advantage and the huge investments you’ve already made in your data systems, you need to realise the bottom-line benefits of meaningful customer engagement as soon as possible.