Going Green - The climate change opportunity in banking

Study of U.S. consumers with key findings that demonstrates the significant opportunity for banks by offering green solutions

Contents

Executive Summary

Introduction

Key Finding #1: Climate Change is the Top Social Challenge Facing the United States Today

Key Finding #2: Americans Don’t Track Their Carbon Footprint—or Try to Reduce It

Key Finding #3: Consumers Want to Buy from Companies with Climate-Friendly Policies

Key Finding #4: Young Consumers Want Banks’ Help in Managing Their Climate Impact

Key Finding #5: Consumers Want Climate-Friendly Checking Account Features

Sizing the Climate-Conscious Market

Competing on a Climate Change Strategy

About Author / Cornerstone Advisors

Climate change is a hot (no pun intended)—and controversial—topic in the United States. While many financial institutions are implementing environmentally friendly policies regarding their carbon impact and energy usage, a new study of U.S. consumers demonstrates that there is a significant opportunity for banks and credit unions to win business and gain a competitive advantage by competing on a climate-based strategy. Key findings from the study include:

- Climate change is the top social challenge facing the United States today.

- Americans don’t track their carbon footprint—or take actions to reduce it.

- Consumers want to do business with companies that have policies for protecting the climate.

- Younger consumers want their banks’ help in managing their climate impact.

- Consumers want climate-friendly checking account features.

To capitalize on the opportunities to serve climate-oriented consumers, banks and credit unions should pivot their existing strategies or create new lines of business or digital bank subsidiaries with climate-focused products and policies.

A new study from the Intergovernmental Panel on Climate Change (IPCC)—the United Nations’ body for assessing the science related to climate change—concluded that:

"Is unequivocal that human influence has warmed the atmosphere, ocean and land. From a physical science perspective, limiting human-induced global warming to a specific level requires limiting cumulative CO2 emissions, reaching at least net zero CO2 emissions, along with strong reductions in other greenhouse gas emissions. Strong, rapid and sustained reductions in CH4 emissions would also limit the warming effect resulting from declining aerosol pollution and would improve air quality.”

What does this have to do with banking? A recent Reuters article claims:

“Climate change could upend the financial system because physical threats such as rising sea levels, as well as policies and carbon-neutral technologies aimed at slowing global warming, could destroy trillions of dollars of assets.”

According to Acting Comptroller of the Currency Michael Hsu, “U.S. regulators will eventually have to factor climate change risks into bank capital rules,” although it’s too soon to say when that would be necessary. Risk.net writes that changes to the environment have incurred costs on banks’ returns on investment in a broad range of scenarios, including:

- Farm loans not being repaid due to poor crop yields caused by extremely dry weather

- Manufacturing debtors shutting down water-heavy productions because of unexpected water shortages, which are becoming increasingly common

- Plastic producers losing significant amounts of business due to new legislation on plastic pollution.

- Debtors based in regions that are regularly overwhelmed by extreme weather events

- Debtors receiving huge environmental fines from authorities for unclean production practices and waste pollution

The view from banks

Banks aren’t oblivious to this. An Accenture study conducted in May 2021 found that 71% of U.S. banks can monitor and assess their carbon footprint today, and 67% are prepared to direct capital away from the energy sector to assist in the transition to a low-carbon economy.

In addition, the study found that 62% of banks are monitoring clients’ emissions and environmental profiles, but many find the availability and granularity of the data is insufficient to assess climate risk and the financial risk associated with evaluating lending decisions.

A study from CDP Worldwide suggests, however, that banks are underestimating their climate-related risks. According to the report:

“It is more common for financial institutions to identify climate-related risks they classify as operational risks (41% of financial institutions) than credit risks (35% of financial institutions) and market risks (26% of financial institutions). Yet the credit and market risks identified have a much higher reported potential financial impact—up to $1 trillion between credit risks and market risks. It follows that some banks have not yet identified risks in their financing portfolios, which will be of a greater magnitude than those in their own operations.”

What is a carbon footprint?

The term “carbon footprint” gets used frequently in climate-related discussions, but many people are hard-pressed to define exactly what it is. According to a Meniga report titled “Carbon Conscious Banking”:

“An individual’s carbon footprint is an estimation of the total greenhouse gases emitted by the activities they undertake, and the products they buy and consume.”

About the report

What can banks do to help consumers understand and manage their carbon footprints? Do consumers even want their banks involved in their efforts to measure and manage their environmental impact? This report, based on a survey of U.S. consumers, will look at consumers’ attitudes and behaviors regarding climate change and the role they want banks to play in their environmental efforts.

About the data

In July 2021, Cornerstone Advisors surveyed 3,150 U.S. consumers to understand their attitudes and behaviors regarding climate change. The sample was weighted to be representative of the overall U.S. adult population in terms of age, gender, and race. At a 95% confidence level, the margin of error on the findings of this study is 2%.

Climate Change is the Top Social Challenge Facing the United States Today

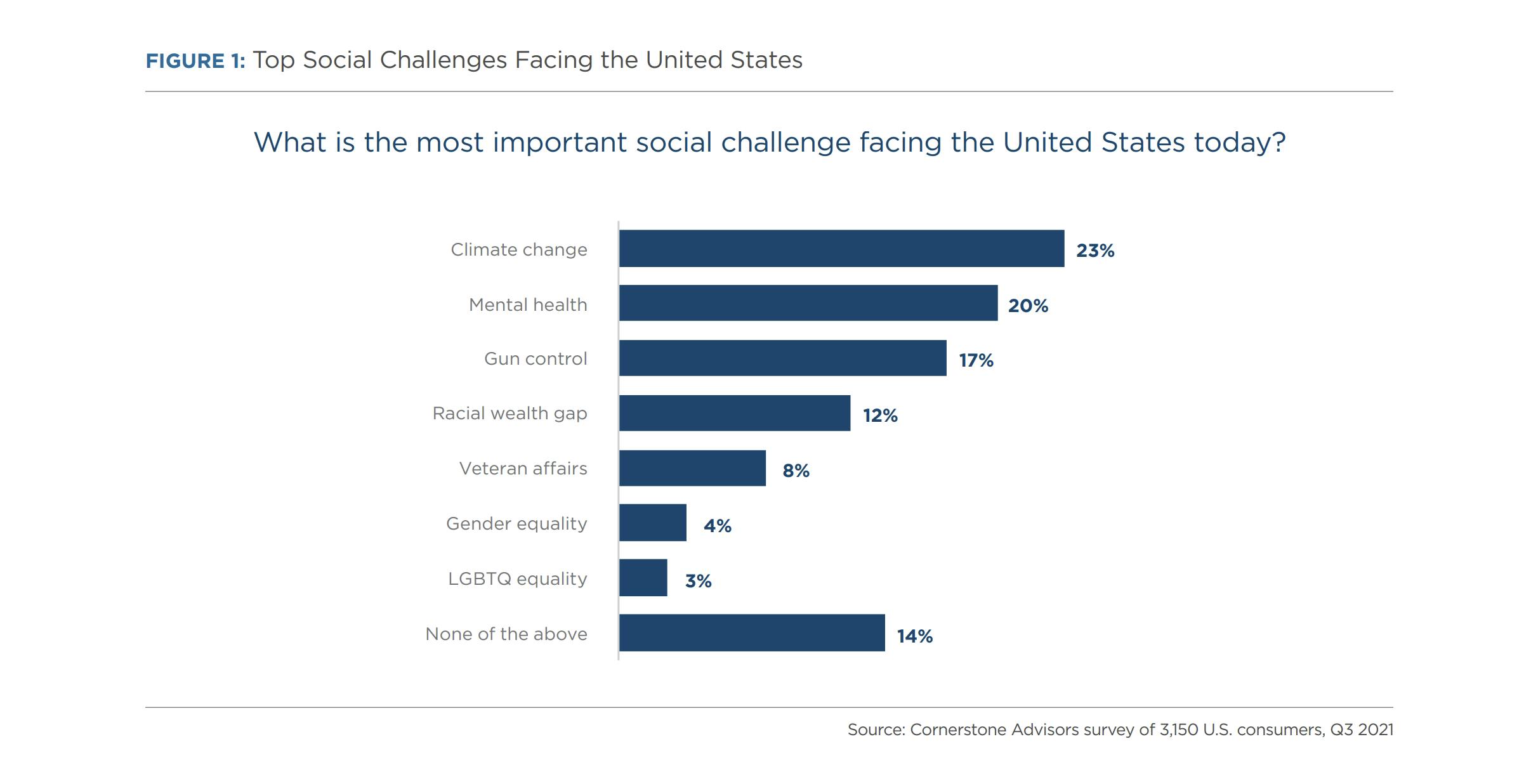

From a list of seven social challenges facing the United States today, 23% of consumers selected climate change as the most important challenge. Mental health was the second most-frequently cited challenge, followed by gun control (Figure 1).

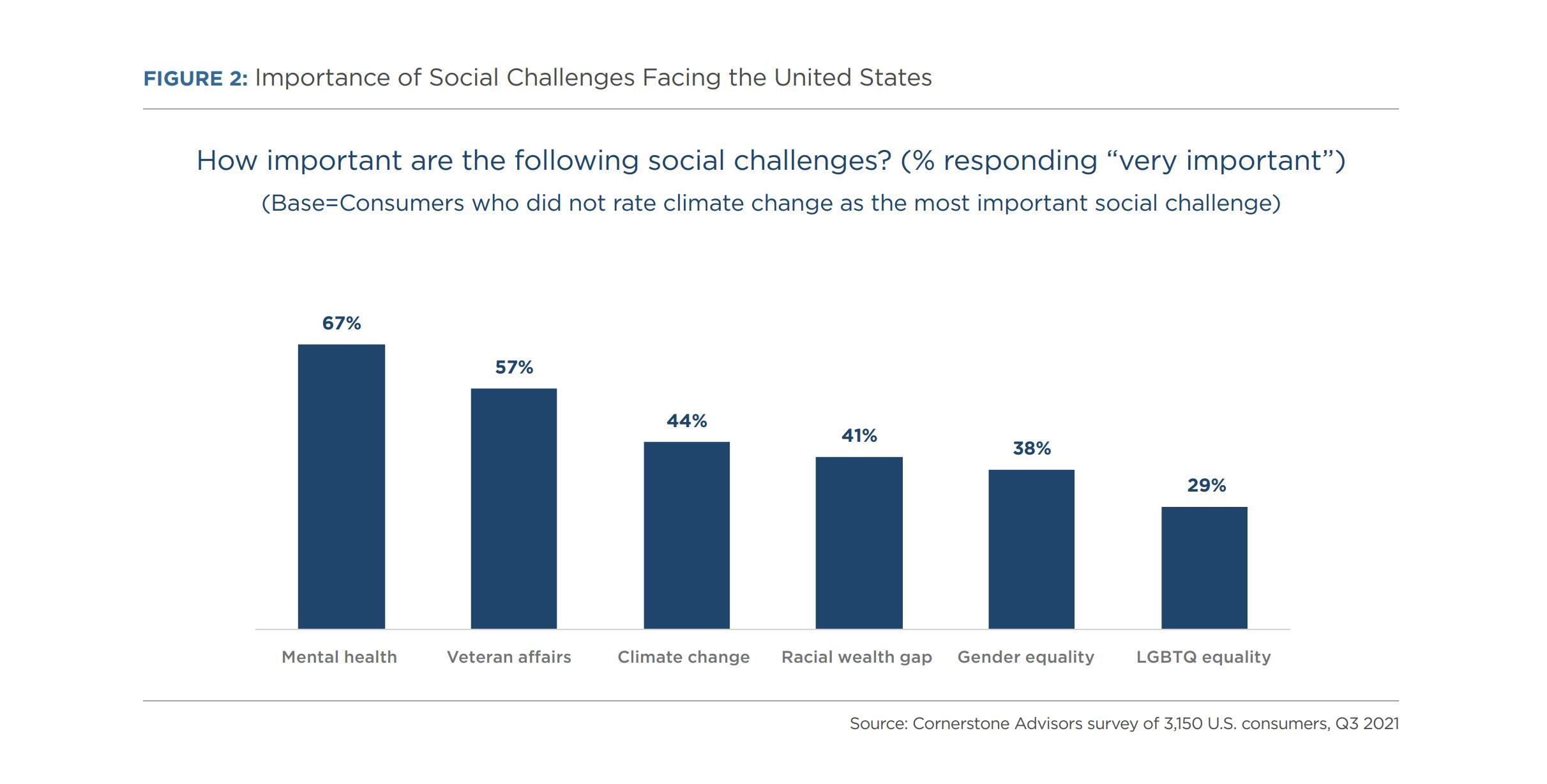

Beyond the 23% of consumers who believe climate change is the most important challenge facing the United States today, 44% see it as a very important challenge (Figure 2). Overall, a majority of Americans recognize climate change as a critical issue facing the country.

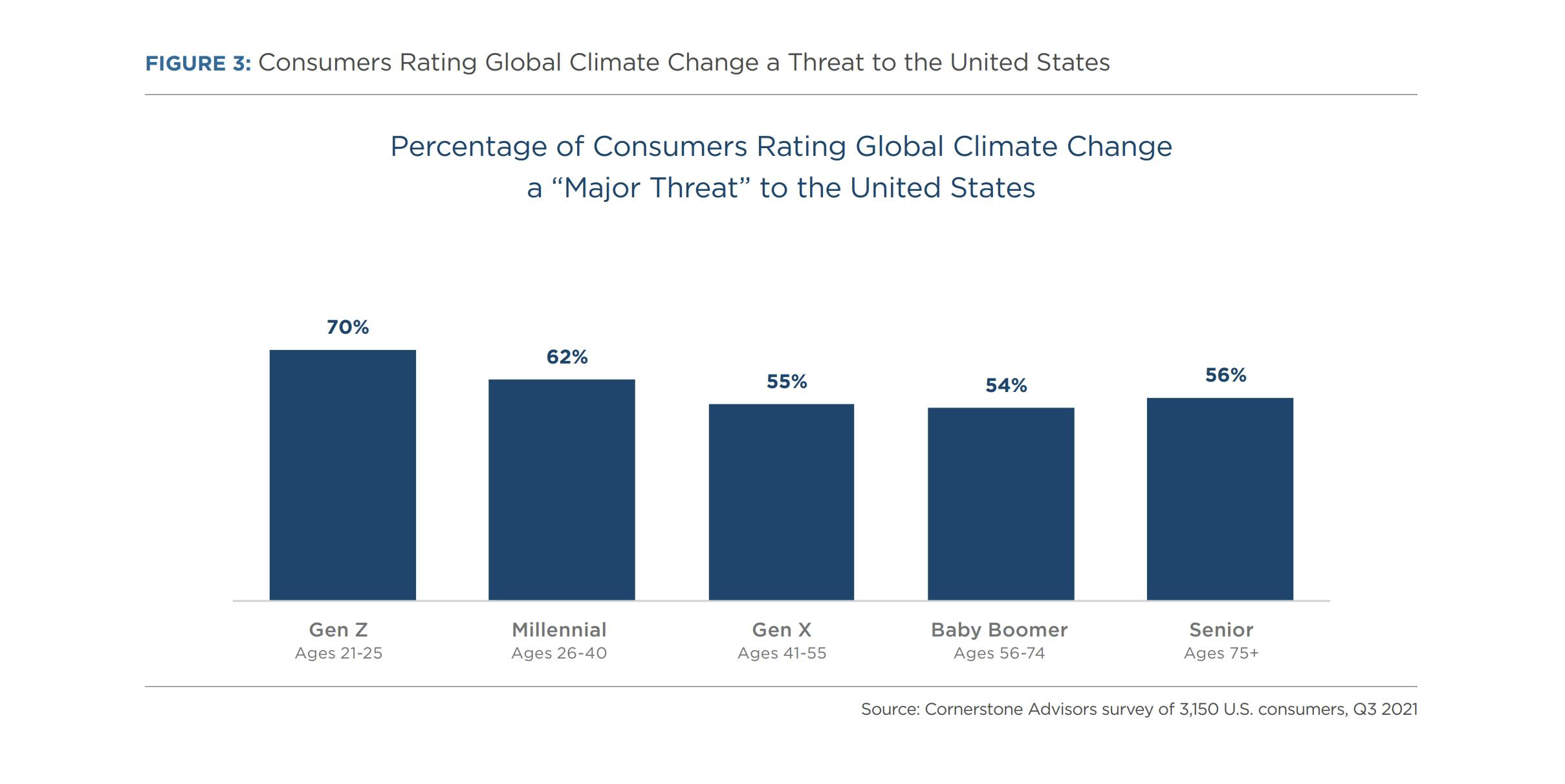

Younger consumers, in particular, see global climate change as a threat to the United States. Seven in 10 Gen Zers and roughly six in 10 Millennials cited global climate as a “major threat” to the country (Figure 3).

Americans Don’t Track Their Carbon Footprint—or Try to Reduce It

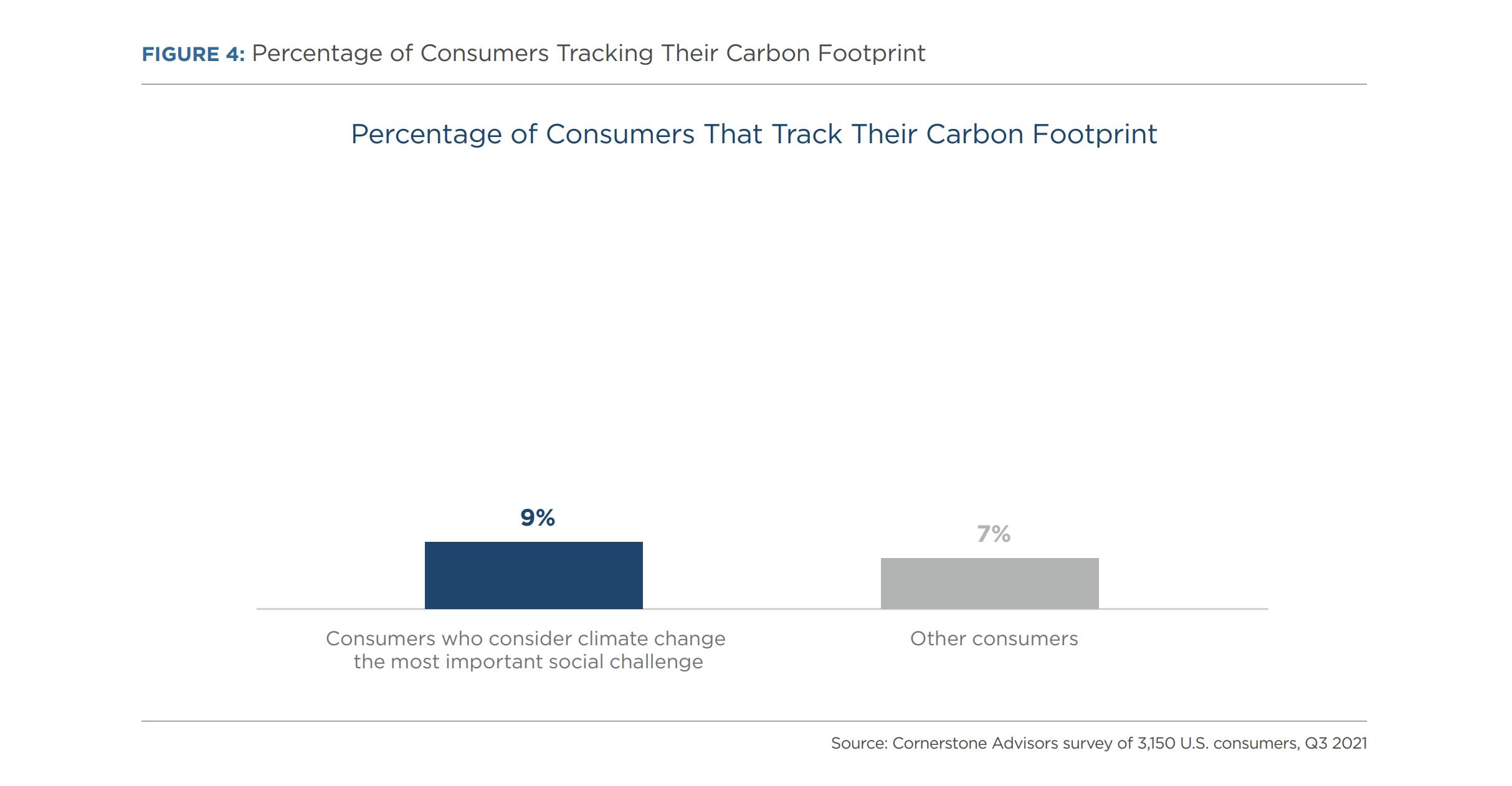

Despite the strong concern for climate change, few consumers track their carbon footprint. In fact, among consumers who consider climate change to be the most important social challenge, just 9% track their carbon footprint. Among the rest of the population, that percentage isn’t far behind at 7% (Figure 4).

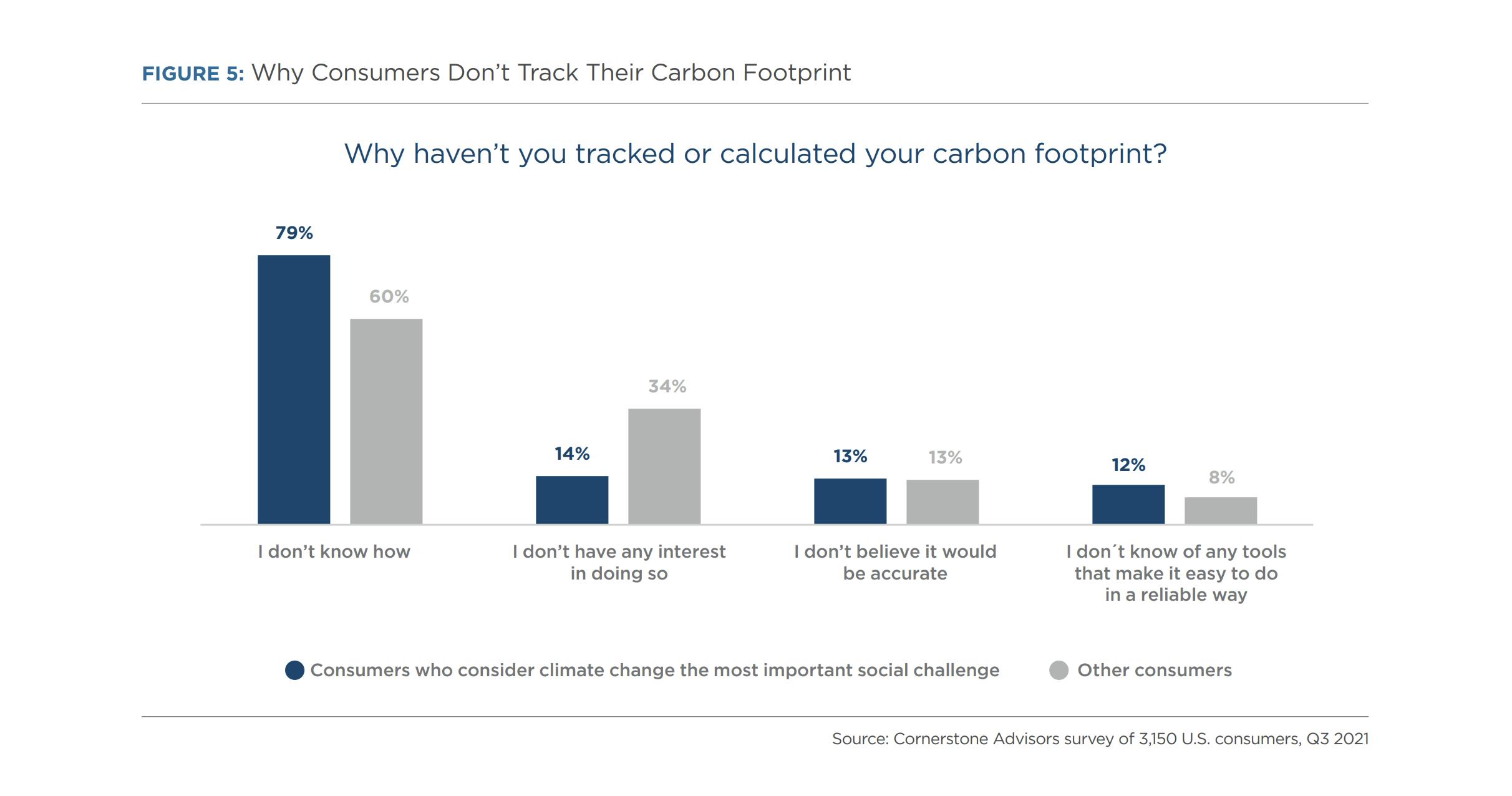

Why don’t consumers track their carbon footprint? They don’t know how. Among those who consider climate change to be the most important social challenge, eight in 10 cited this reason as did six in 10 other consumers. And it’s not like those other consumers aren’t interested in doing so—only a third said they don’t have any interest in tracking their carbon footprint (Figure 5).

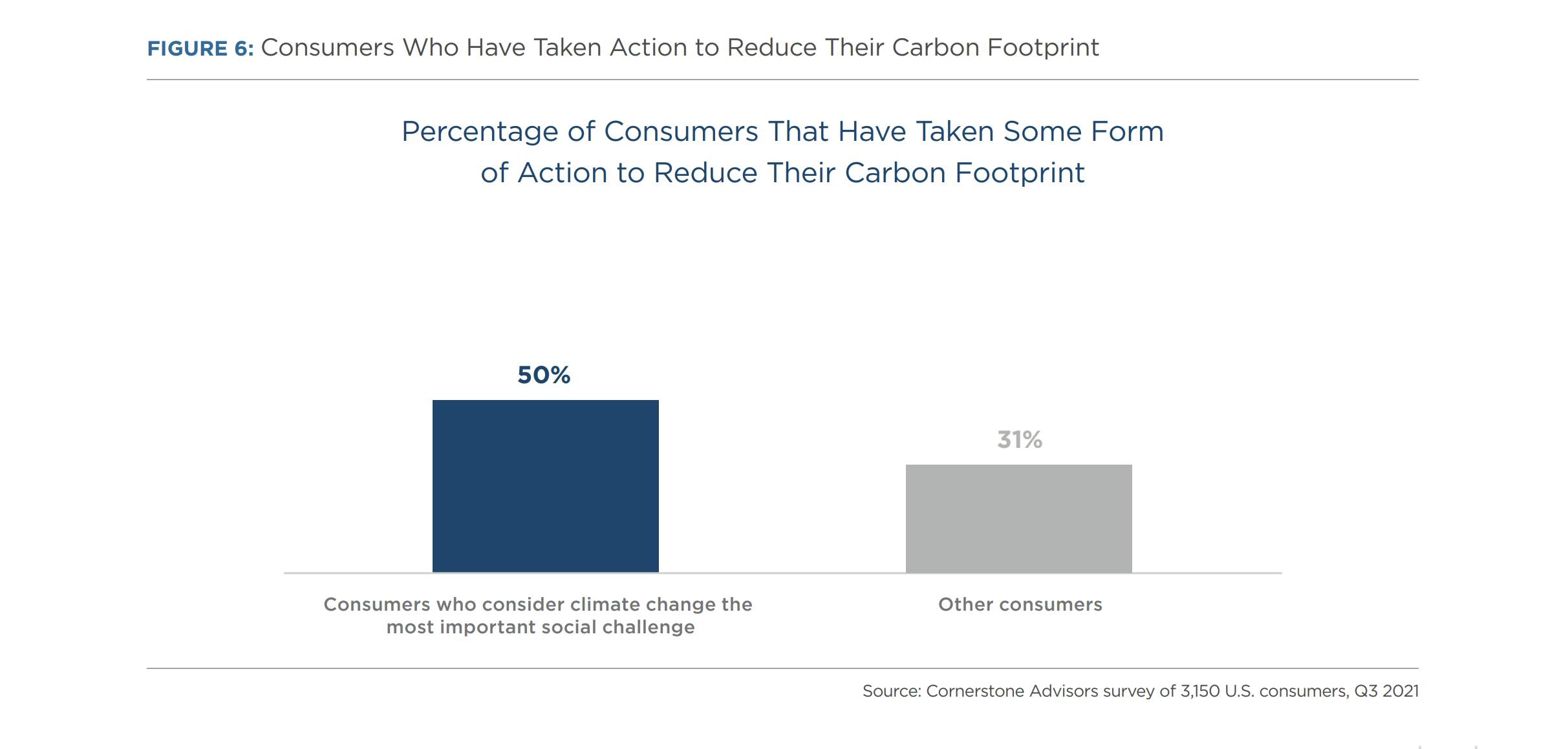

In addition, just half of the consumers who consider climate change the most important social challenge said they’ve taken some form of action to reduce their carbon footprint, in contrast to three in 10 other consumers (Figure 6).

Consumers Want to Buy From Companies with Climate-Friendly Policies

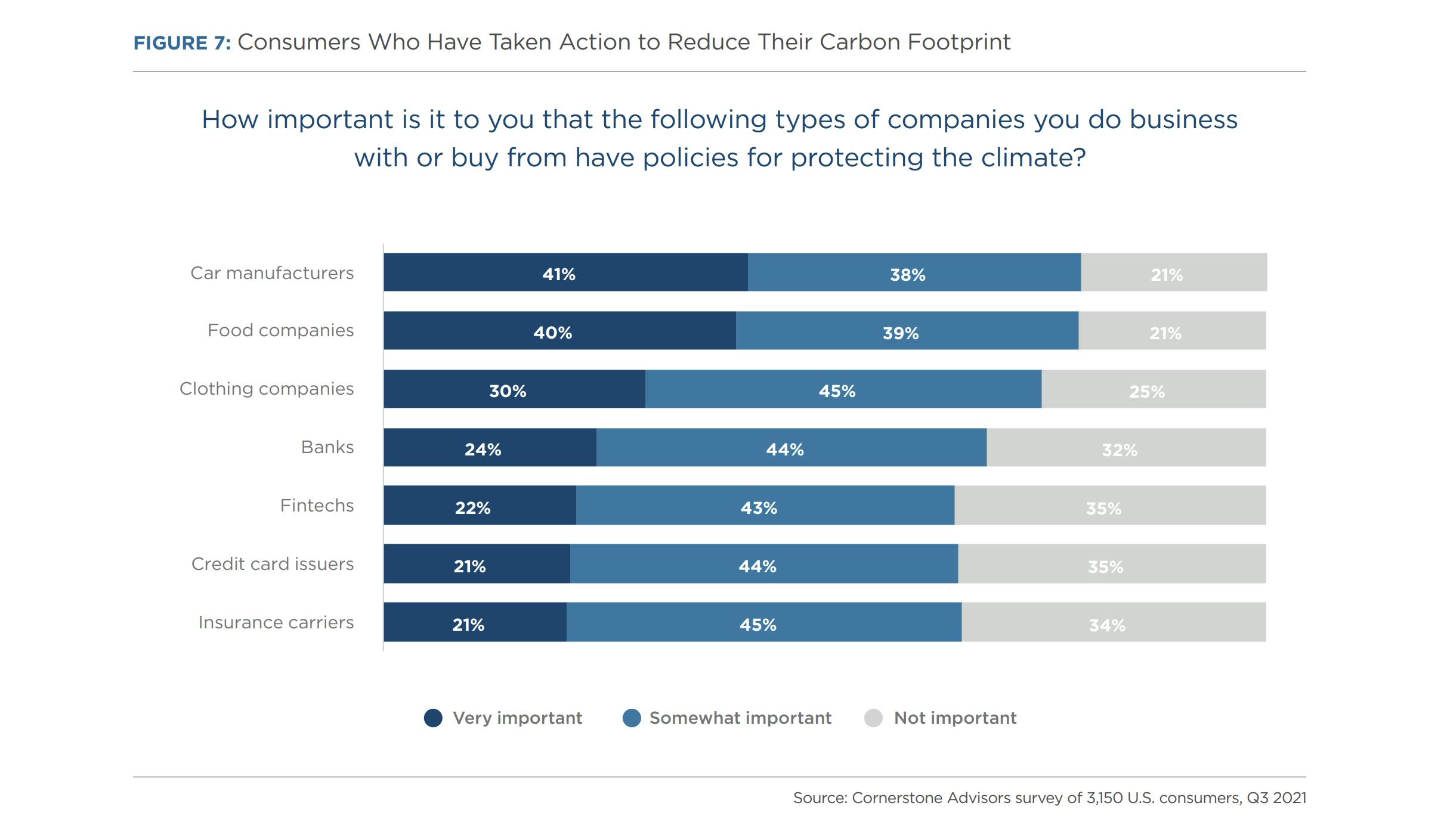

For four in 10 consumers, it’s very important for the car manufacturers and food companies they do business with to have policies for protecting the climate. And for roughly two-thirds of consumers, it’s at least somewhat important that their financial services providers—banks, fintechs, credit card issuers, and insurance carriers—have climate protection policies (Figure 7).

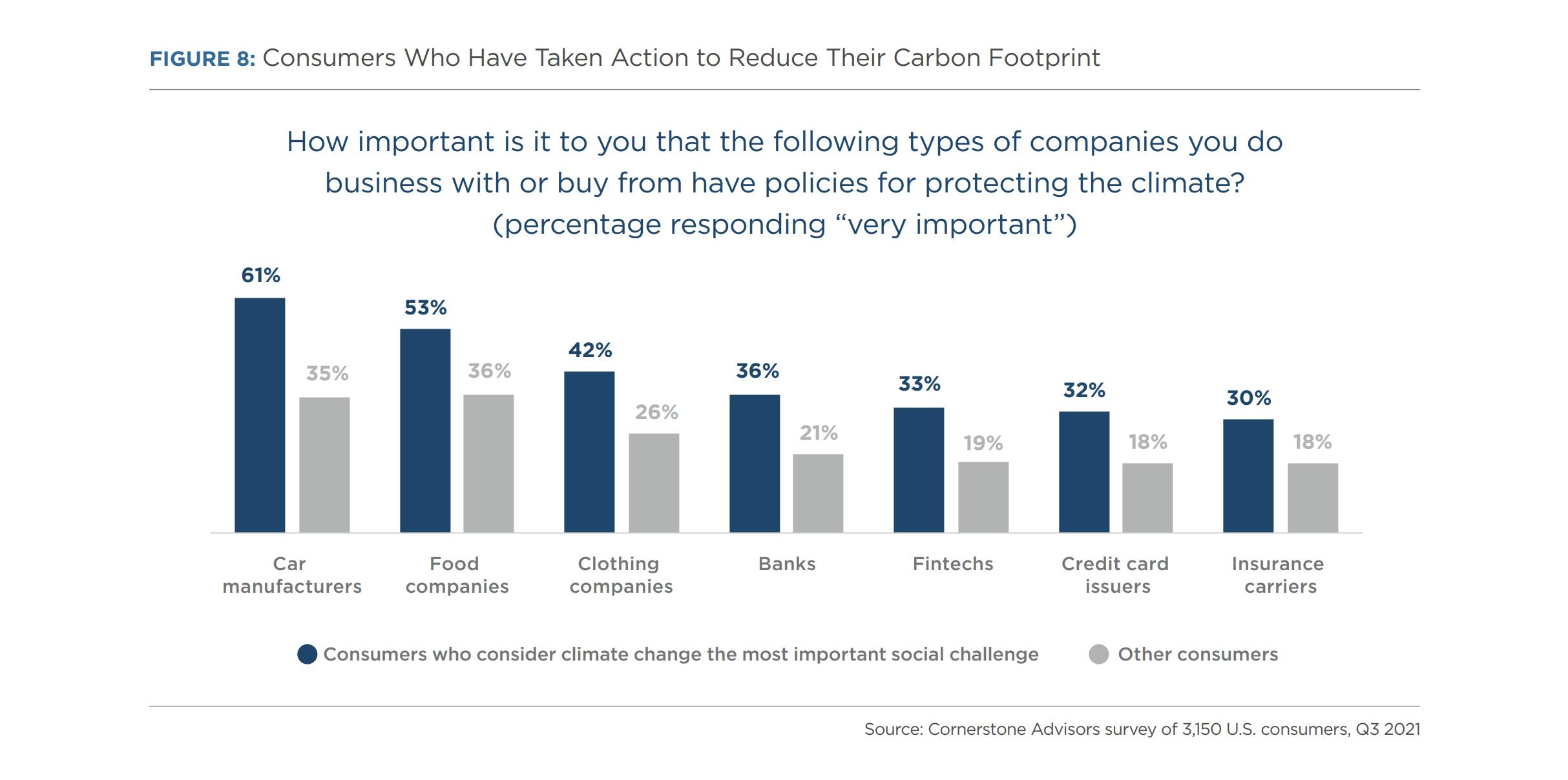

Not surprisingly, doing business with companies with climate protection policies is even more important to consumers who consider climate change the most important social challenge (Figure 8).

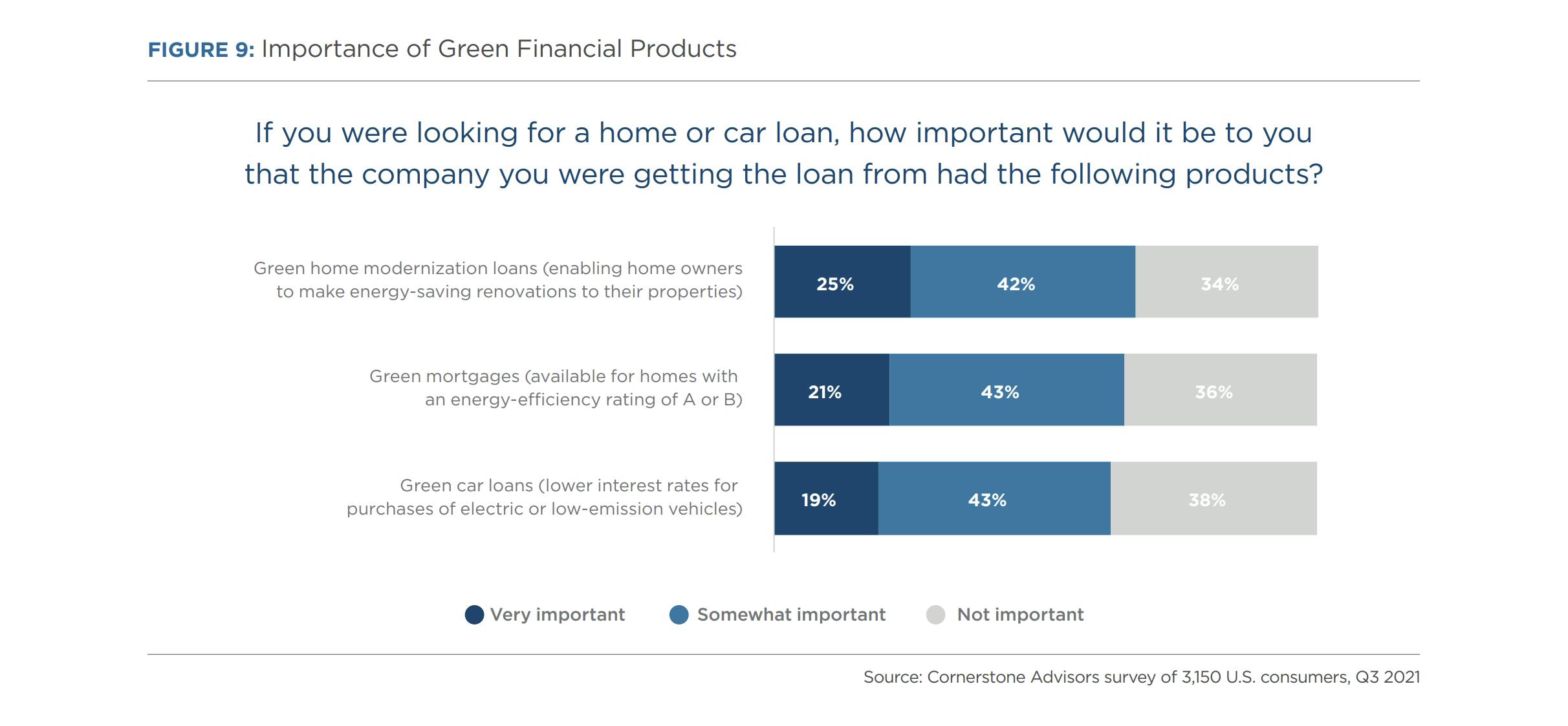

One in four consumers said that if they were in the market for a home or car loan, doing business with a bank that offered green home modernization loans would be very important to them, while about four in 10 said it would be somewhat important. In addition, one in five consumers said it would be very important to them that their lender offered green mortgages and green car loans (Figure 9).

Young Consumers Want Banks’ Help in Managing Their Climate Impact

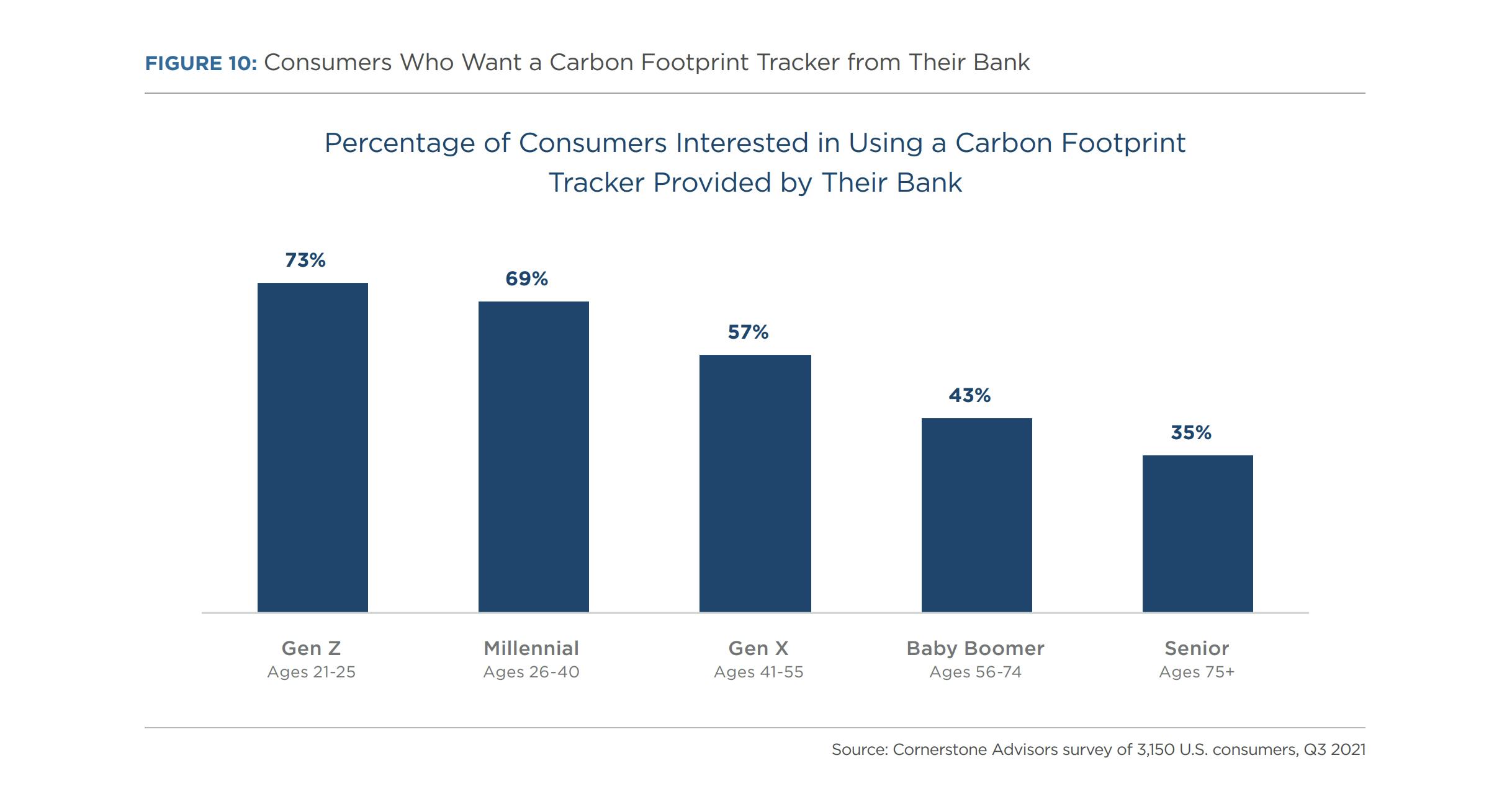

Roughly three-quarters of Gen Zers and seven in 10 Millennials expressed interest in using a carbon footprint tracker provided by their bank (Figure 10).

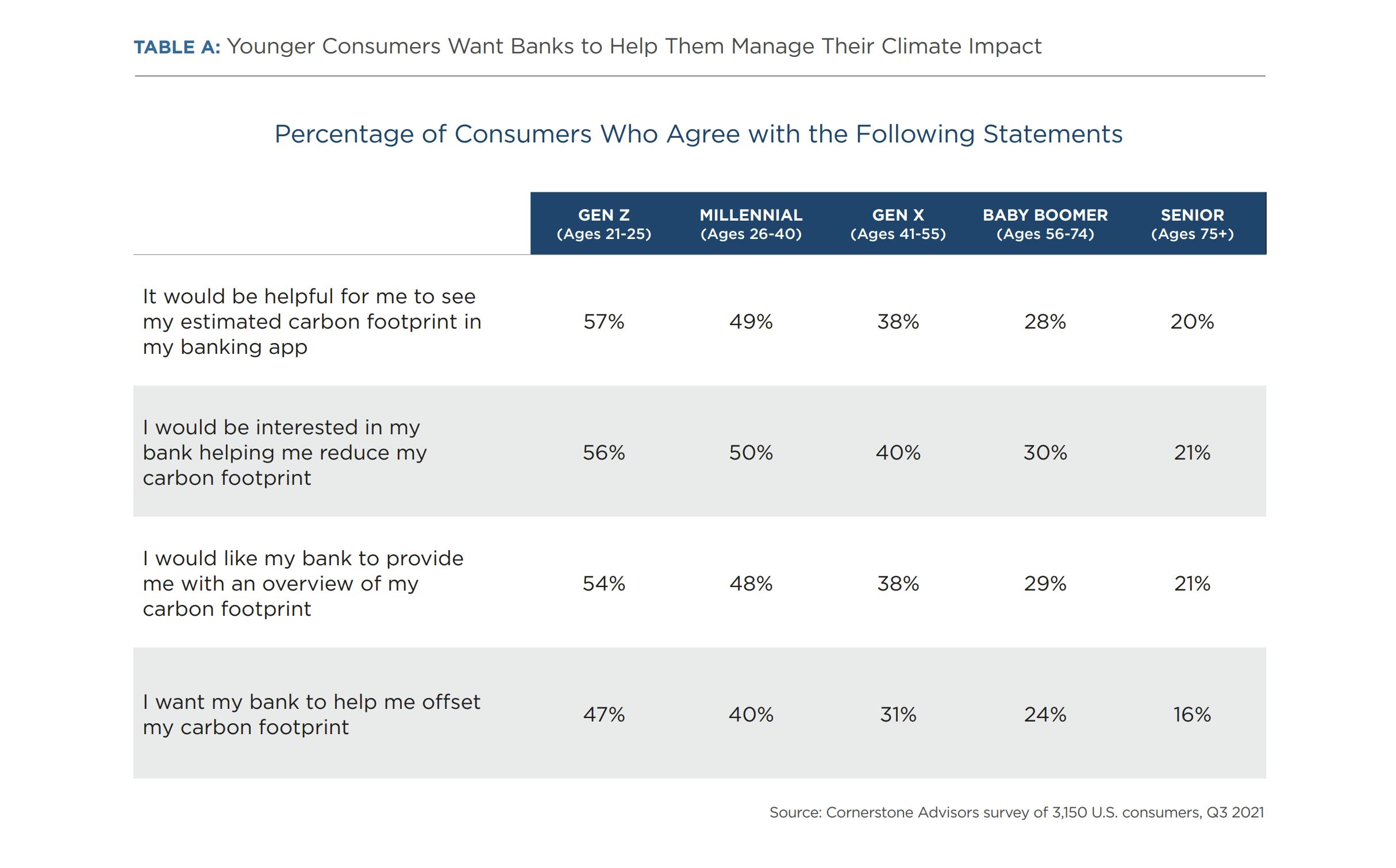

More than half of Gen Zers and about half of Millennials said they’re interested in: 1) seeing their estimated carbon footprint in their bank’s mobile app; 2) getting help from their bank to reduce their carbon footprint; and 3) having their bank provide them with an overview of their carbon footprint. In addition, about half of Gen Zers and four in 10 Millennials want their bank to help them offset their carbon footprint (Table A).

Consumers Want Climate-Friendly Checking Account Features

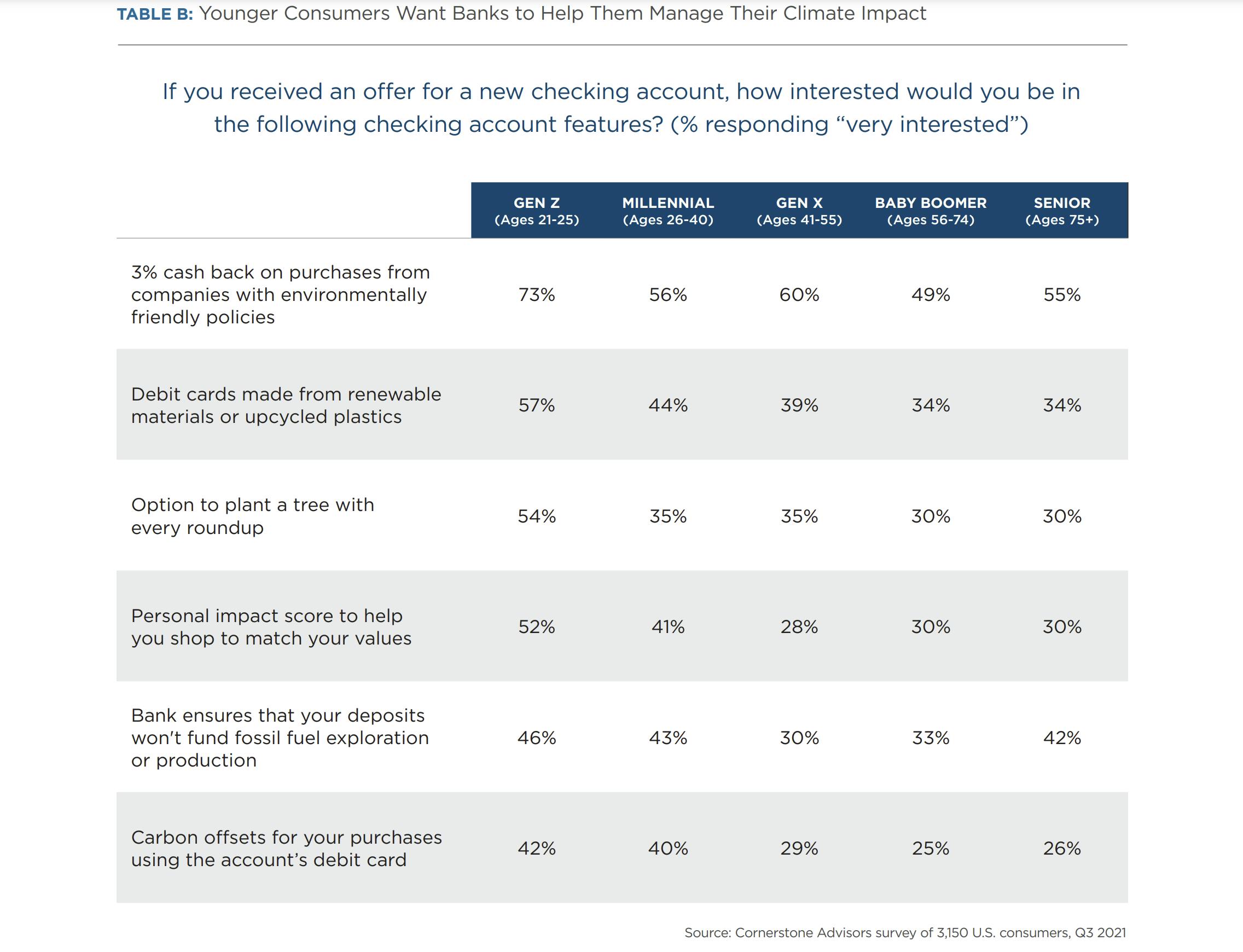

Not surprisingly, consumers of all ages said they’re very interested in getting 3% back on purchases from companies with environmentally friendly policies. In addition, however, many Gen Zers and Millennials said they’re very interested in debit cards made from renewable materials, the option to plant a tree with purchase roundups, a personal impact score to help them match their shopping behaviors to their values, and bank policies that ensure their deposits won’t fund fossil fuel exploration or production (Table B).

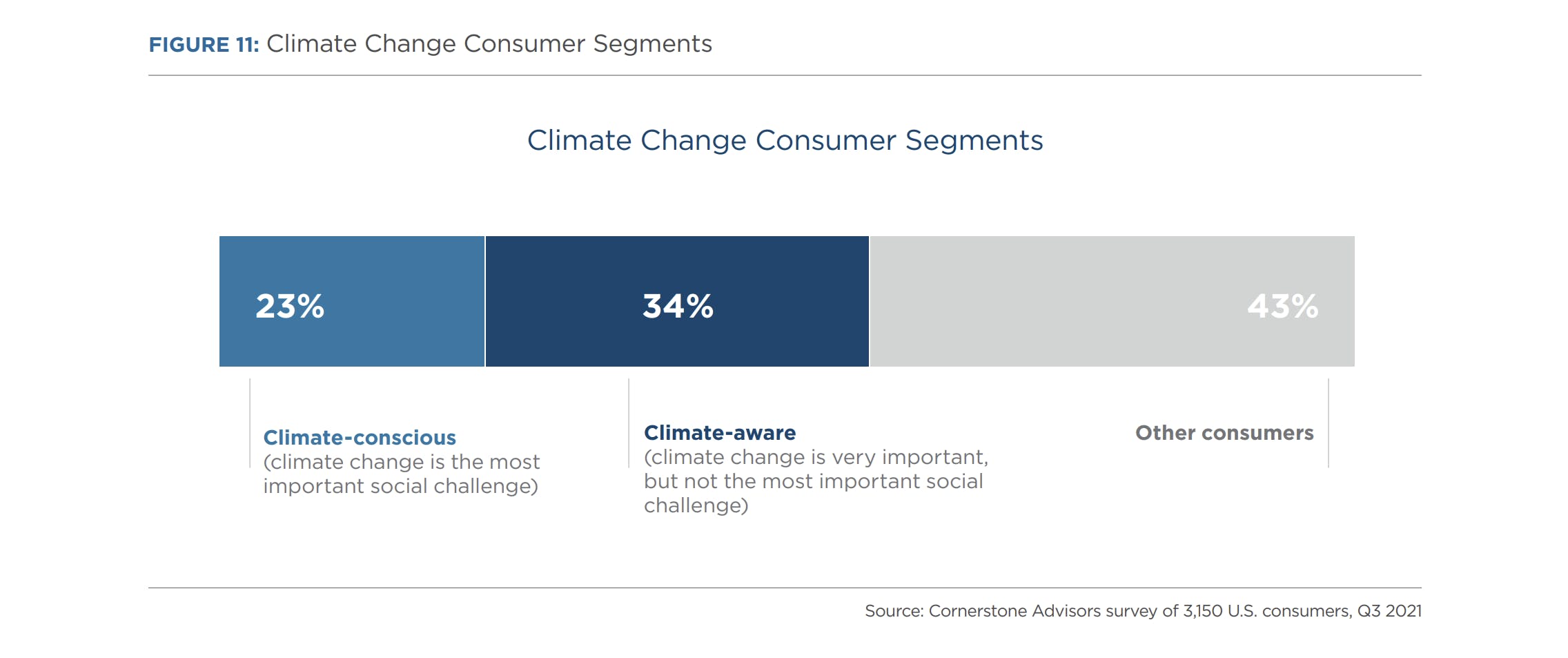

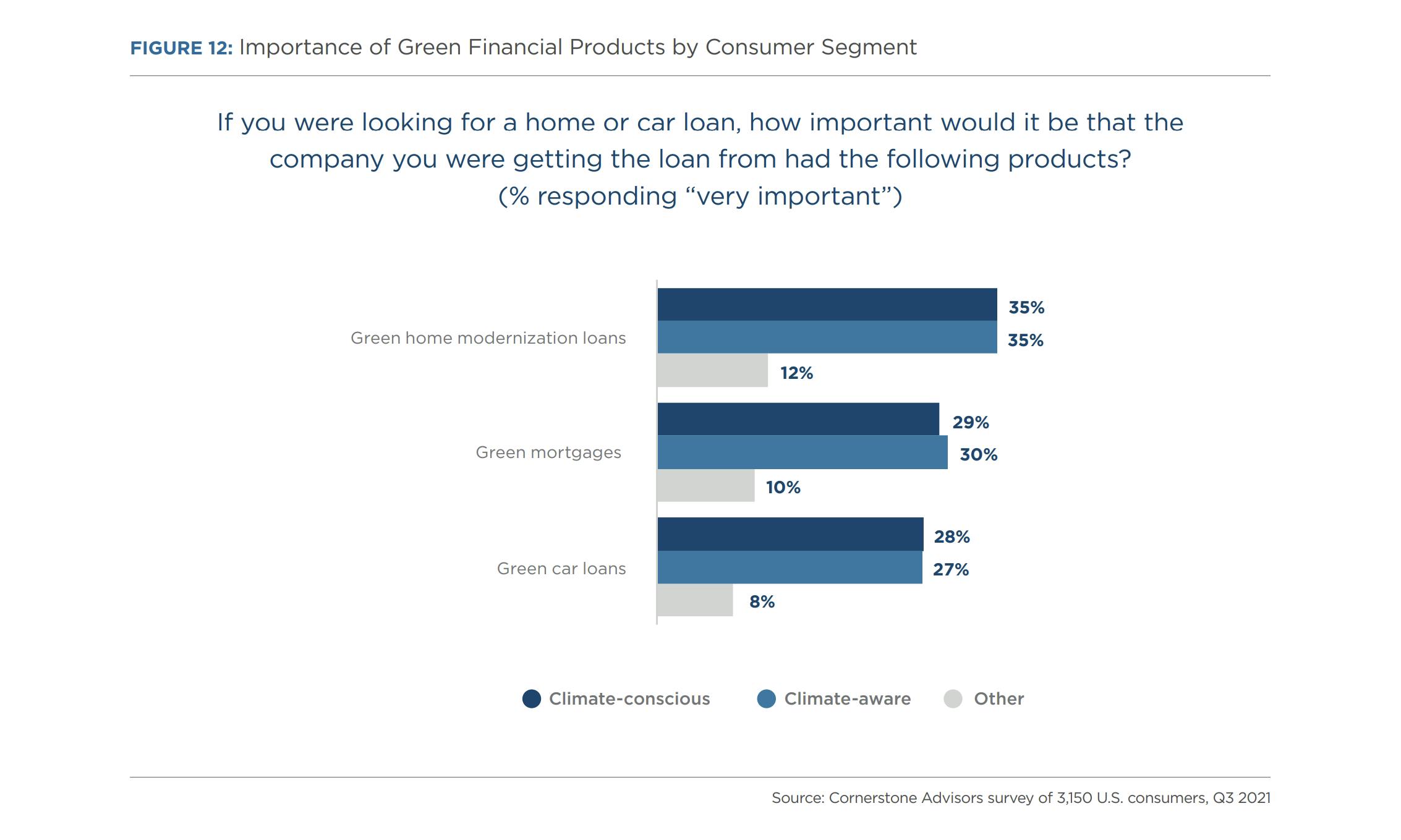

We segmented survey respondents into three groups: 1) Climate-conscious consumers—the 23% who listed climate change as the most important social challenge facing the United States; 2) Climate-aware consumers —the 34% who said climate change was a very important challenge but didn’t cite it as the most important challenge; and 3) Other consumers (Figure 11).

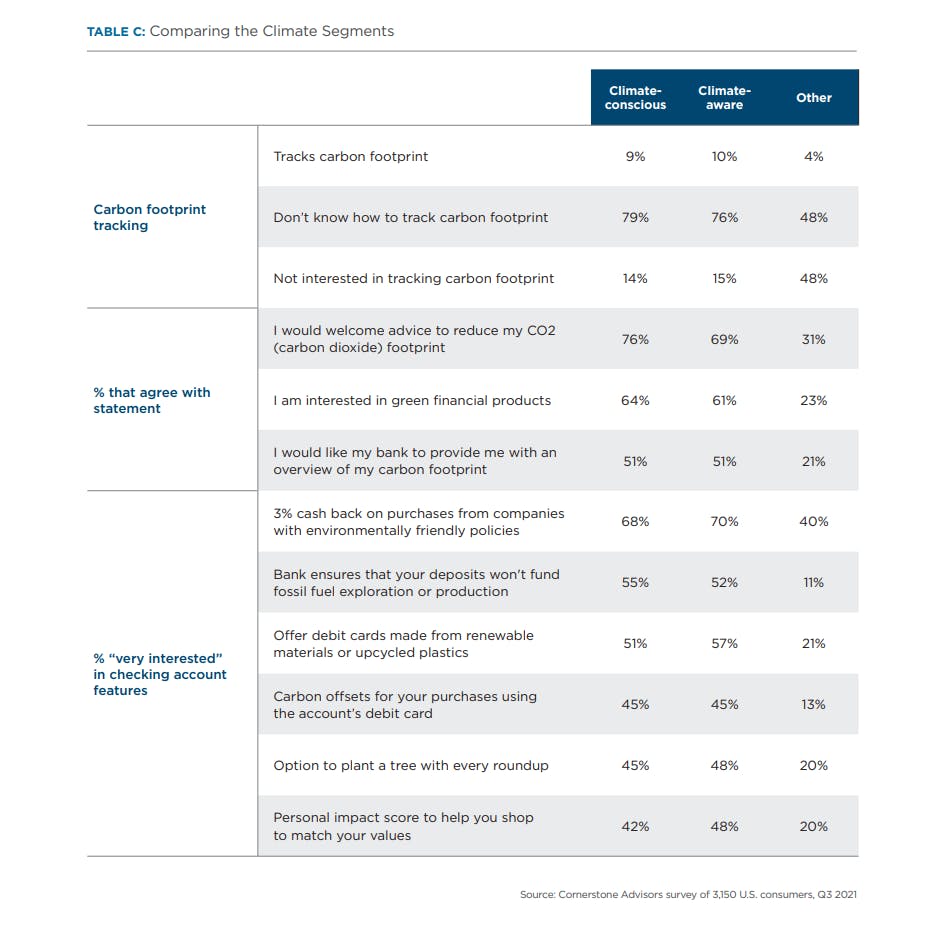

Key finding: In terms of attitudes and behaviors, Climate-conscious and Climate-aware consumers are very similar. For example, a similar percentage of consumers in both segments track their carbon footprint. Just 15% of Climate-aware consumers—even though they don’t consider climate change to be the most important social challenge facing the United States—aren’t interested in tracking their carbon footprint. The percentages of consumers in both segments are nearly identical in terms of those welcoming advice on reducing their carbon footprint, their interest in green financial products, and whether they’d like their bank to provide them with an overview of their carbon footprint. In addition, the percentages of consumers in both segments are nearly identical regarding their interest in environmentally friendly checking account features (Table C).

Geographic distribution of the climate segments

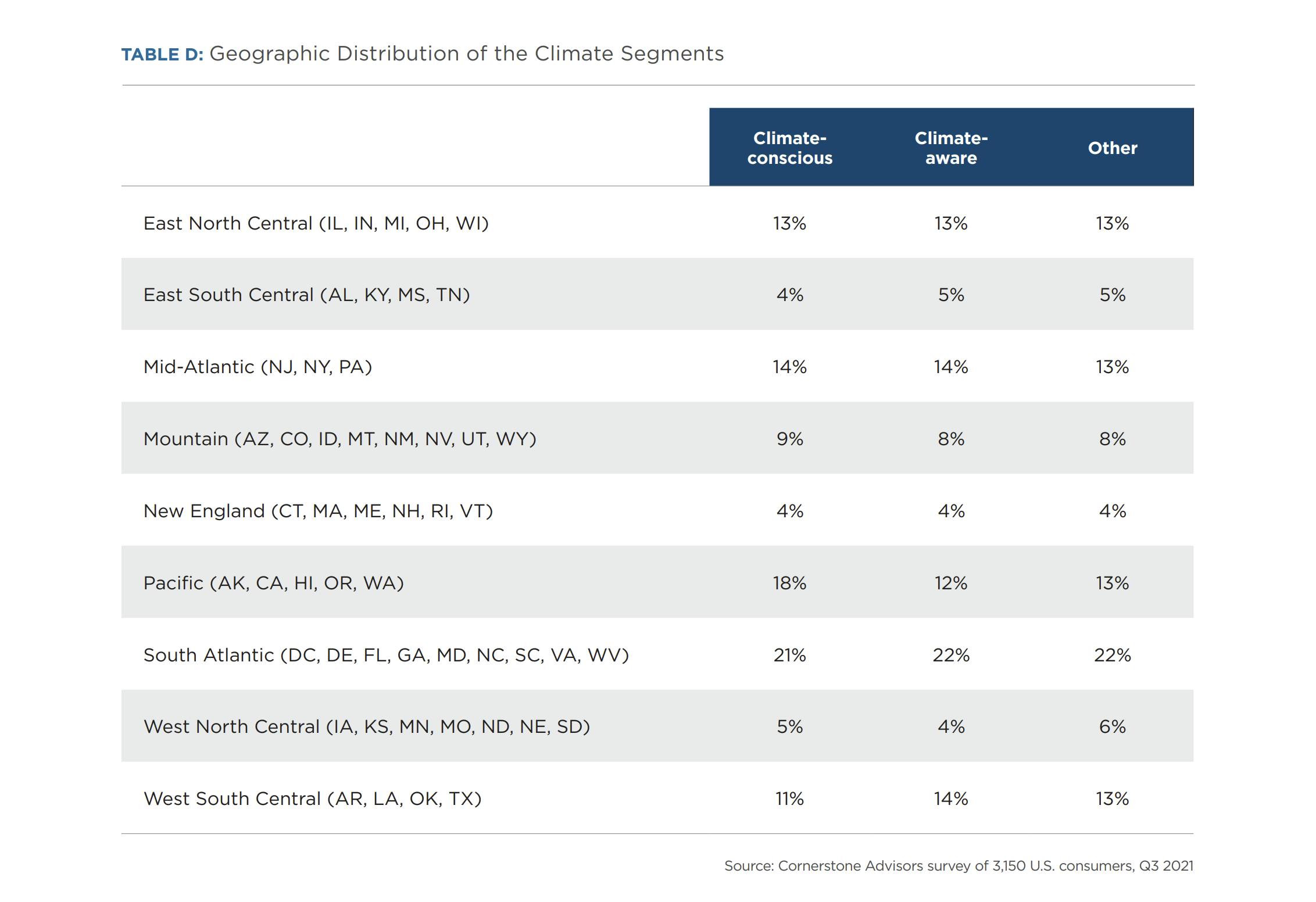

While it may also be tempting to think that Climate-conscious and Climate-aware consumers are concentrated in a few states on the coast, that wasn’t the case. The only region that over-indexes on Climate-conscious consumers (and only slightly, at that) is on the West Coast (Table D).

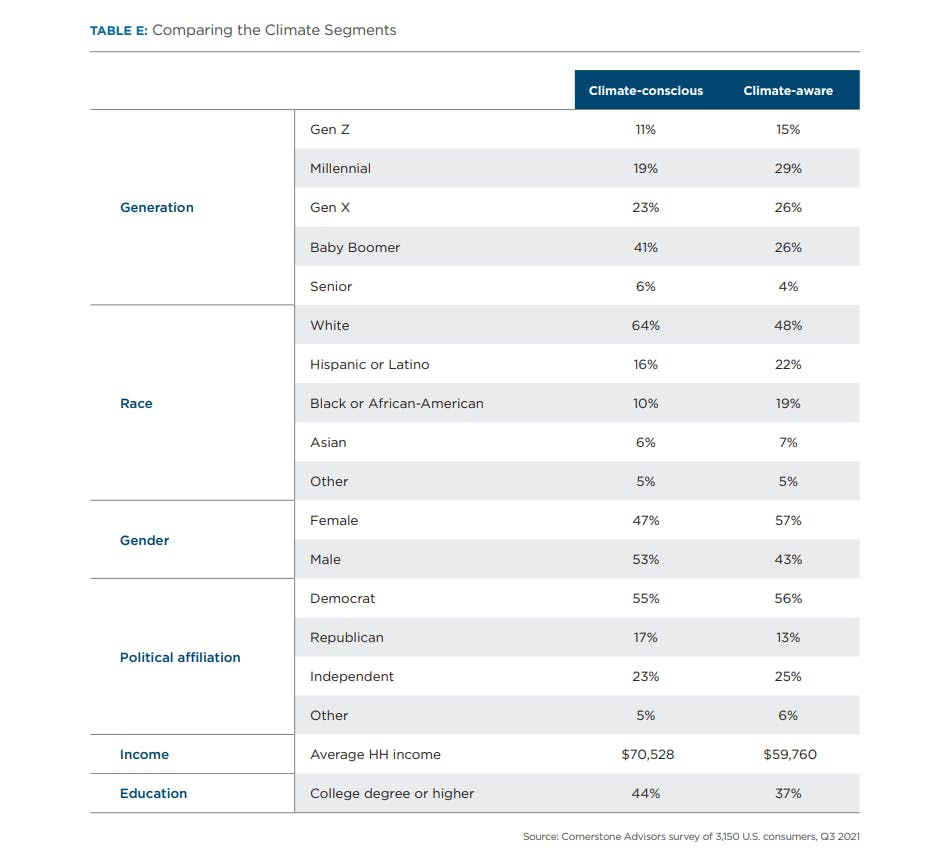

The demographic composition of the climate segments

Demographically, however, the Climate-conscious and Climate-aware segments differ. The Climate-conscious group comprises a larger percentage of White, male, Baby Boomers. The Climate-aware segment contains more Millennials, females, and Hispanic and Black consumers (Table E).

One striking difference between the two climate segments and other consumers is their political affiliation. Just 17% of the Climate-conscious consumers, and 13% of the Climate-aware segment identify themselves as Republicans, in contrast to 47% of other consumers. Among those other consumers, just 20% consider themselves Democrats.

The deposit and loan potential of the climate segments

Although the Climate-conscious consumers account for just 23% of the overall population, with roughly $788 billion in deposits, they hold 35% of the total deposits held in banks. The average checking account balance for Climate-conscious consumers is nearly $14,000—50% higher than the national average.

In contrast, the Climate-aware segment has $555 billion in deposits (24% of the total). Other consumers—who comprise 43% of the total population—have $931 billion in deposits, 41% of the total.

From a lending perspective, about one in five consumers in each of the three segments borrowed money in the past three years. Climate-conscious consumers accounted for 34% of the total funds borrowed and averaged nearly $110,000 per loan—roughly double the average loan size of both the Climate-aware and Other consumers.

The overall conclusion from the key findings and analysis of the climate change segments is that banks and credit unions have an opportunity to compete with the megabanks and fintechs by adopting or focusing on a climate change strategy.

Banks and fintechs pursuing a climate change strategy include both large and mid-size institutions and companies including:

- Bank of the West. With $96 billion in assets, Bank of the West offers a checking account that donates 1% of net revenues generated by the account to an environmental nonprofit and tracks the carbon footprint associated with each purchase. In addition, the bank claims to have “near zero” exposure to fossil fuels. The bank’s chief marketing officer told Scientific American that it has implemented some of “the strongest environmental policies in terms of what we do and do not finance,” including policies that restrict or prohibit the bank from financing coal-fired power plants, fracking wells, Arctic drilling, palm oil, tobacco, wood pulp and more.

- Amalgamated Bank. With approximately $6.6 billion in assets, Amalgamated is the largest union-owned lender in the United States and calls itself “America’s socially responsible bank.” Amalgamated says that customers’ deposits won’t be used to finance major emitters and touts the clean energy portfolios and financial services it provides for environmental organizations, progressive political campaigns, and renewable energy projects. The bank’s “Partnership for Carbon Accounting Financials” aims to standardize a methodology for banks to measure the carbon emissions associated with financing activities.

- Greenpenny. Launched out of Decorah Bank of Iowa, Greenpenny was created to enable change by inspiring the use of clean energy. As Decorah Bank evolved into an energy-responsible leader in the community, the bank began measuring its carbon footprint in 2008. It also became a known source of financing for solar installations in Northeast Iowa. Money deposited in Greenpenny is secure, earns interest, and is only used to finance renewable energy projects, starting with solar.

- Climate First Bank. This Florida-based bank launched in June 2021 and claims it has been carbon neutral from its start. Its goal is to become “the most impactful bank contributing to the drawdown of atmospheric CO2” by lending to solar and energy-efficient retrofits.

- Aspiration. Founded by Vice President Al Gore’s senior speechwriter, Andrei Cherny, the fintech has grown to nearly 1 million customers since it launched in 2015. In 2017, the company went live with Aspiration Impact Measurement (AIM), which rates companies on how well they treat people and the planet. Aspiration customers also receive an AIM score based on their purchase behavior. In 2020, Aspiration initiated two new programs: 1) Plant Your Change, which plants a tree for every purchase by rounding up to the nearest dollar, and 2) Planet Protection, which makes Aspiration customers’ driving carbon neutral by calculating their carbon consumption from their debit card gas purchases.

Recommendations

Strategically, creating a climate change strategy could be done by pivoting an institution’s existing strategy or by creating a new line of business or subsidiary (i.e., digital bank) to pursue Climate-conscious and Climate-aware consumers. To compete on a climate change strategy and capitalize on the economic opportunities with these consumers, financial institutions should:

- Develop an environmental impact education program. Just 30% of Climate-conscious consumers said they’re taking actions to reduce their carbon footprint. Yet, many of them say they recycle, use reusable water bottles, get eStatements instead of paper, and do other things that have a positive impact on the environment. So why did they say they don’t take action to reduce their carbon footprint? Lack of education. Banks’ education programs should be tailored to consumers already concerned with climate change, and not focused on trying to convert the unconcerned.

- Integrate a carbon footprint tracker in their mobile banking app. As custodians of consumers’ personal financial data, banks are in a unique position to make carbon footprints available real-time based on consumers’ spending and energy consumption. Carbon tracker tools available today are labor intensive, require a vast amount of user inputs and are very inaccurate as they rely on consumers’ estimates rather than data. Banks can change this—and, in fact, many consumers express interest in using a carbon footprint tracker from their bank. Creating a separate app or website is an option but may not create as much engagement as a footprint tracker integrated into an institution’s mobile banking app would.

- Enable customers to offset their carbon impact. Integrating a carbon footprint tracker into the digital banking app is a good first step to help build consumers’ awareness of their climate impact and help financial institutions stand out in the market. By incorporating carbon offsetting and other green initiatives and products in their digital banking provision, banks can also help their customers transition from awareness to action.

- Launch a climate impact checking account. Consumers’ strong interest in environmental-related checking account features suggests that banks pursuing a climate change strategy must offer a dedicated climate focused checking account. Banks should create a tiered pricing structure (e.g., freemium model) to generate revenue and offset the cost of providing some features.

- Provide green lending products. Roughly a third of Climate-conscious and Climate-aware consumers say it’s important for a lender to provide green lending products like home modernization loans, green mortgages, and green car loans. These loan products should be part of the offering for any bank pursuing a climate change strategy (Figure 12).

- Develop an ESG investment capability. When asked if they had investments in any funds that are considered “socially responsible” funds, about half of all consumers said they weren’t sure. One in three Climate-conscious consumers and one in four Climate-aware consumers said they have invested in these funds, in contrast to just 8% of other consumers. When asked how they would invest $1,000 if they came into the money, 40% of the climate-focused segments said they would invest at least a quarter of it in socially responsible funds. Just 18% of other consumers said they would invest a quarter or more of the $1,000 in these types of funds.

- Institute internal climate impact policies and metrics. While the previous recommendations have focused on consumer-facing actions community-based financial institutions should take to pursue a climate-change strategy, they should ensure that their internal policies concerning energy use, carbon footprint, and carbon offsetting are consistent with their market strategy. CDP suggests that banks use the Global GHG Accounting and Reporting Standard developed by the Partnership for Carbon Accounting Financials (PCAF).7

Author - Ron Shevlin

Research Director

Ron Shevlin heads up Cornerstone Advisors’ fintech research efforts and authors many of the firm’s commissioned studies. He has been a management consultant for more than 30 years, working with leading financial services, consumer products, retail, and manufacturing firms worldwide. Prior to Cornerstone, Ron was a researcher and consultant for Aite Group, Forrester Research, and KPMG. Author of the Fintech Snark Tank blog on Forbes, Ron is ranked among the top fintech influencers globally, and is a frequent keynote speaker at banking and fintech industry events.

Cornerstone Advisors

At Cornerstone Advisors, our goal is to deliver tangible business impact to financial institutions. We know that when institutions improve their strategies, technology, and operations, enhanced financial performance naturally follows. Because we live by the philosophy that businesses can’t improve what they don’t measure, we show banks and credit unions how to use laser focused measurement to make smarter technology decisions, re-engineer critical processes, and develop more meaningful business strategies.