Cashflow Assistant

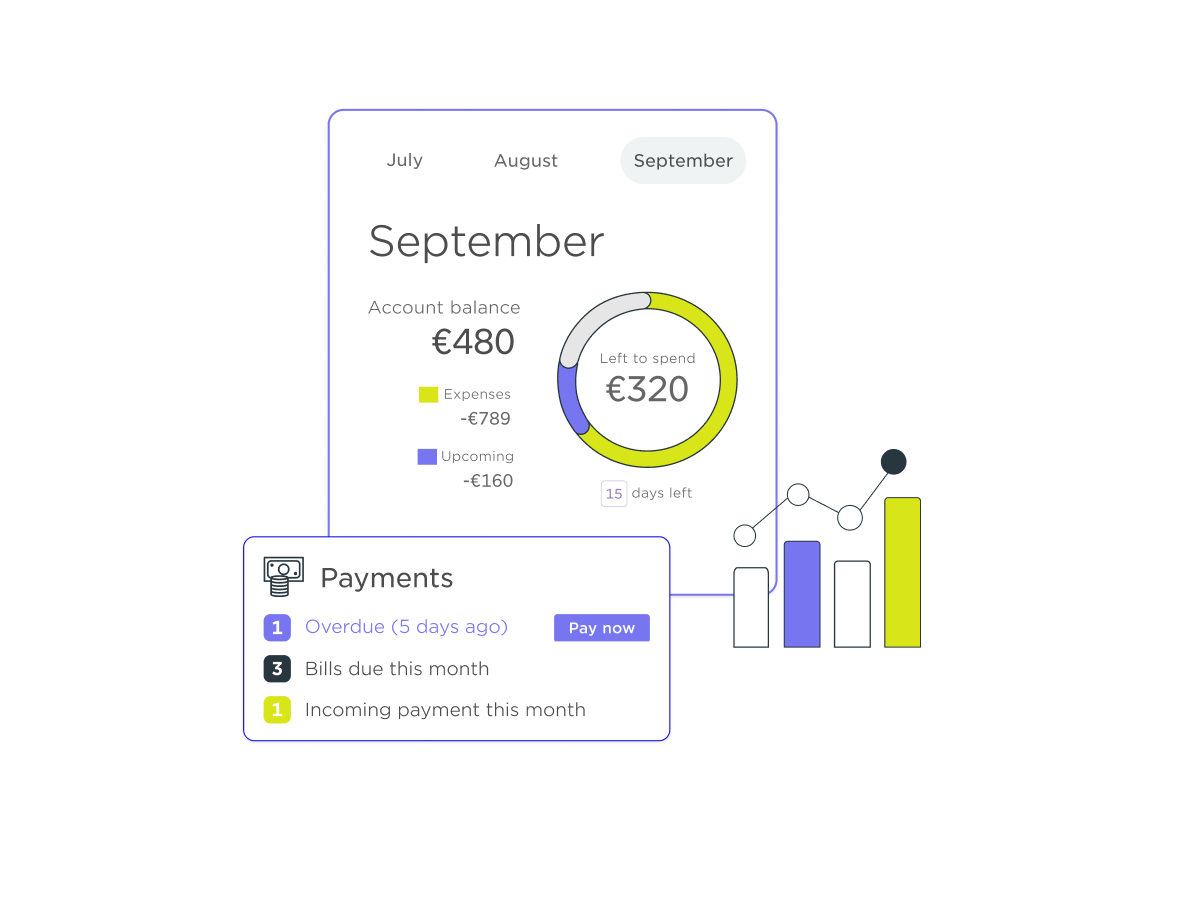

Understanding how money flows in and out of your accounts is crucial for finance management. Cashflow Assistant not only helps your customers understand their balance history but can also project future cash flow.

Finance Management

Finance ManagementBuild trust and loyalty by proactively helping your customers

Cashflow Assistant provides advice to. a customer on when it is safe-to-save or they are free-to-spend

- Builds awareness on which expenses and incomes are recurring

- Shows how much of their expenses are recurring

- Helps pay bills on time by notifying payment due dates

- Alerts when finances are likely to run dangerously low

- helps customers avoid unnecessary fees and advises them when to save to increas financial wealth

- Materially increases sales of credit lines and uptake of savings or investment accounts

Key features of the of the AI-powered Cashflow Assistant service include:

- Balance projection of an account, or group of accounts, by using Machine Learning to analyse past transaction data

- Detecting transactional patterns within user's transaction history

- Match actual transactions to predicted payments (reconciliation)

- Notifications and user events that keep users aware of what is ahead of them financially

- Hide functionality allowing users to play a “what-if” game and see how resigning from certain expenses would affect their future finances

A simple, low-touch way for Businesses to stay in control of their finances

- Identify & tag known recurring transactions from scheduled payments, invoices and account payables & receivables

- Engage customers in confirming upcoming transactions, connecting more data and providing comprehensive overviews

- Use Meniga‘s machine-learning algorithms to predict & reconcile recurring transactions

- Trigger notifications to provide timely reminders and warnings and pitch the right products and the right time