Meniga Savings

Help your customers nurture their finances and watch your engagement rates soar

Meniga Savings

Meniga SavingsThe global cost of living crisis and high interest rates have amplified the importance of savings.

Whether its by helping saving rookies get started, building financial security or reinforcing habits of experienced savers, banks are perfectly placed to help their customers reach their savings goals.

A quarter of UK households have no savings at all

4 out 10 Americans have less than a month of income saved for emergencies

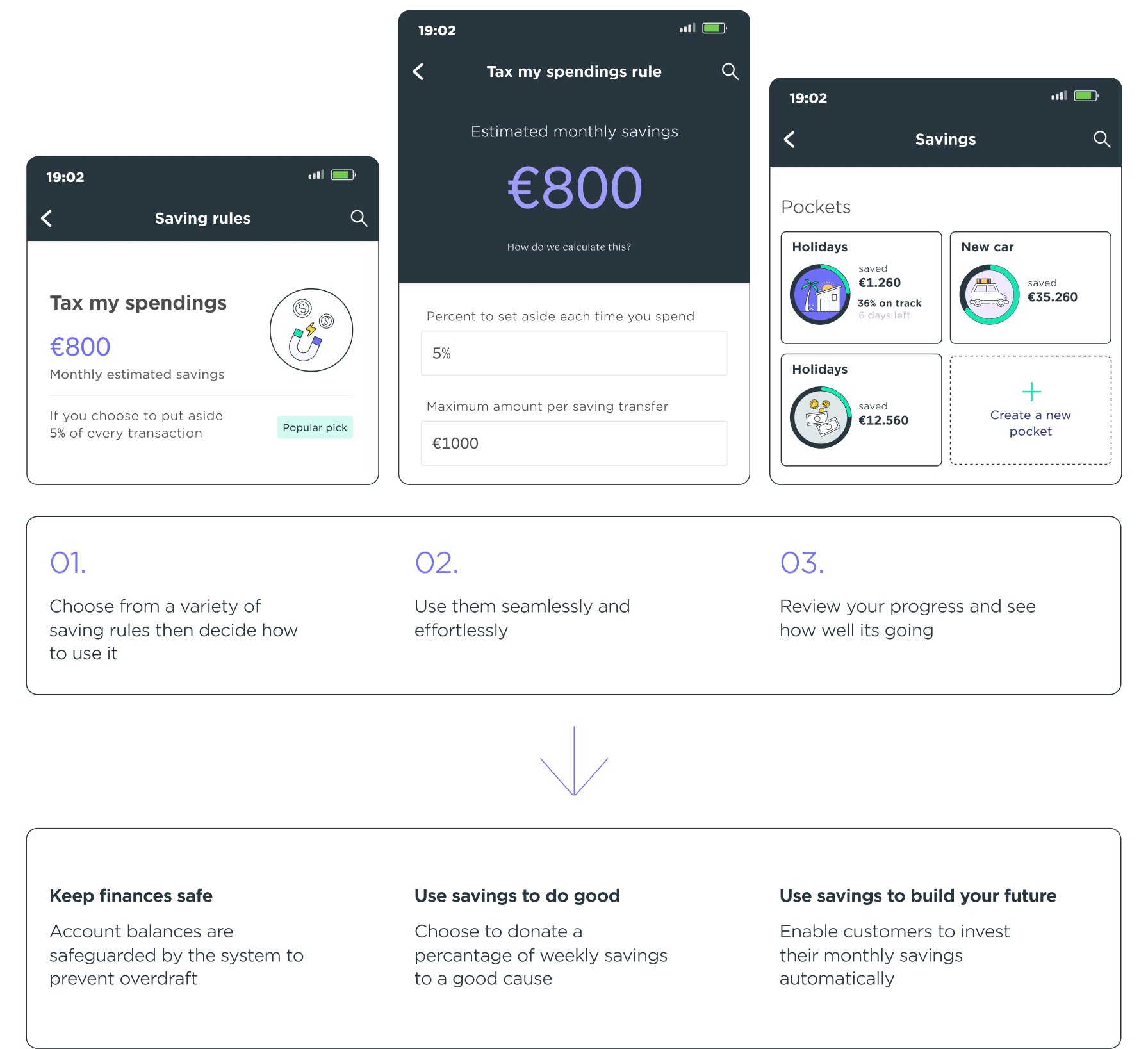

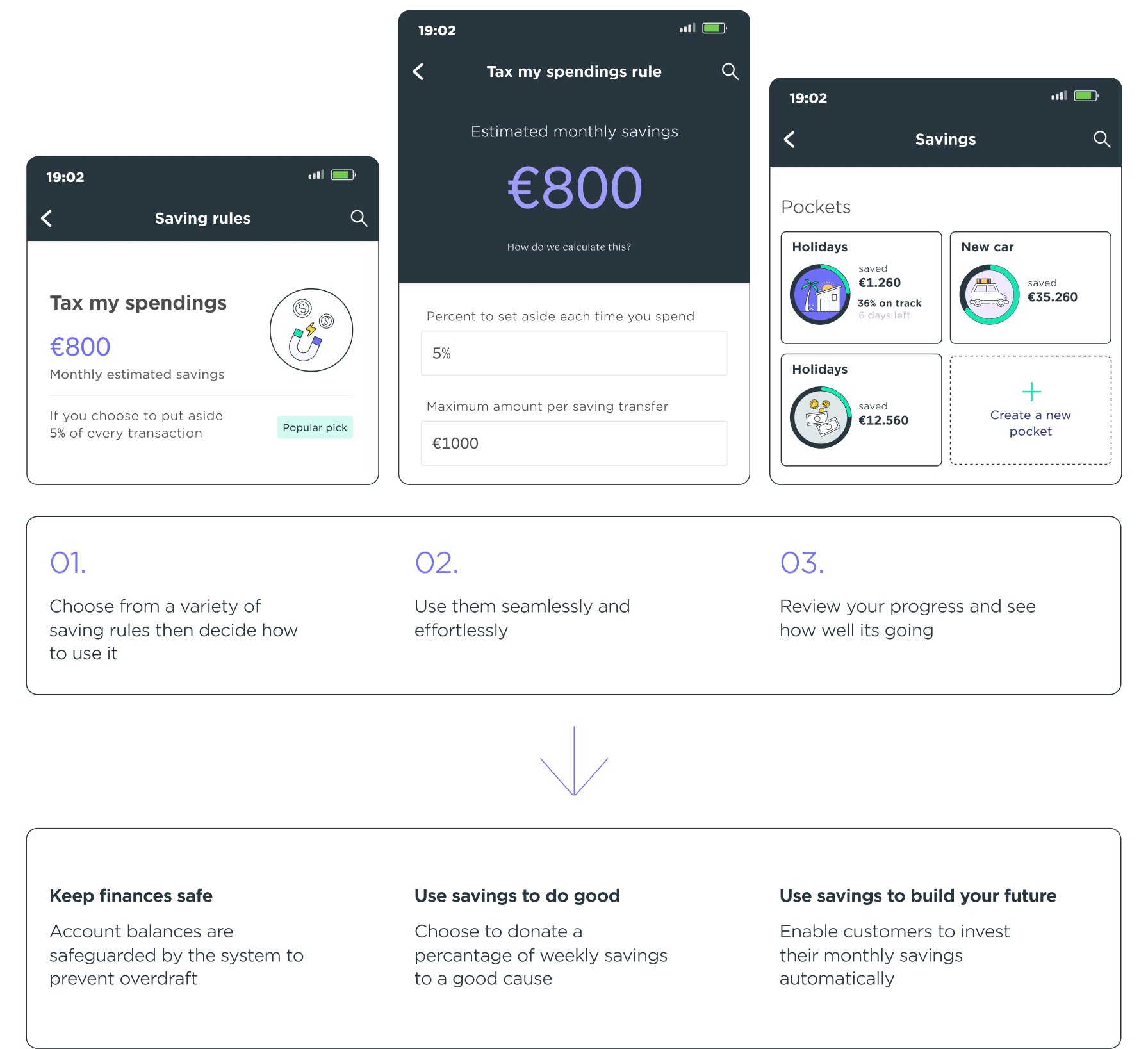

Help customers build savings in a gamified way

Meniga can automatically save money for customers and help

them effectively and effortlessly manage their savings through a

variety of fun savings modules

Meniga’s Savings Modules

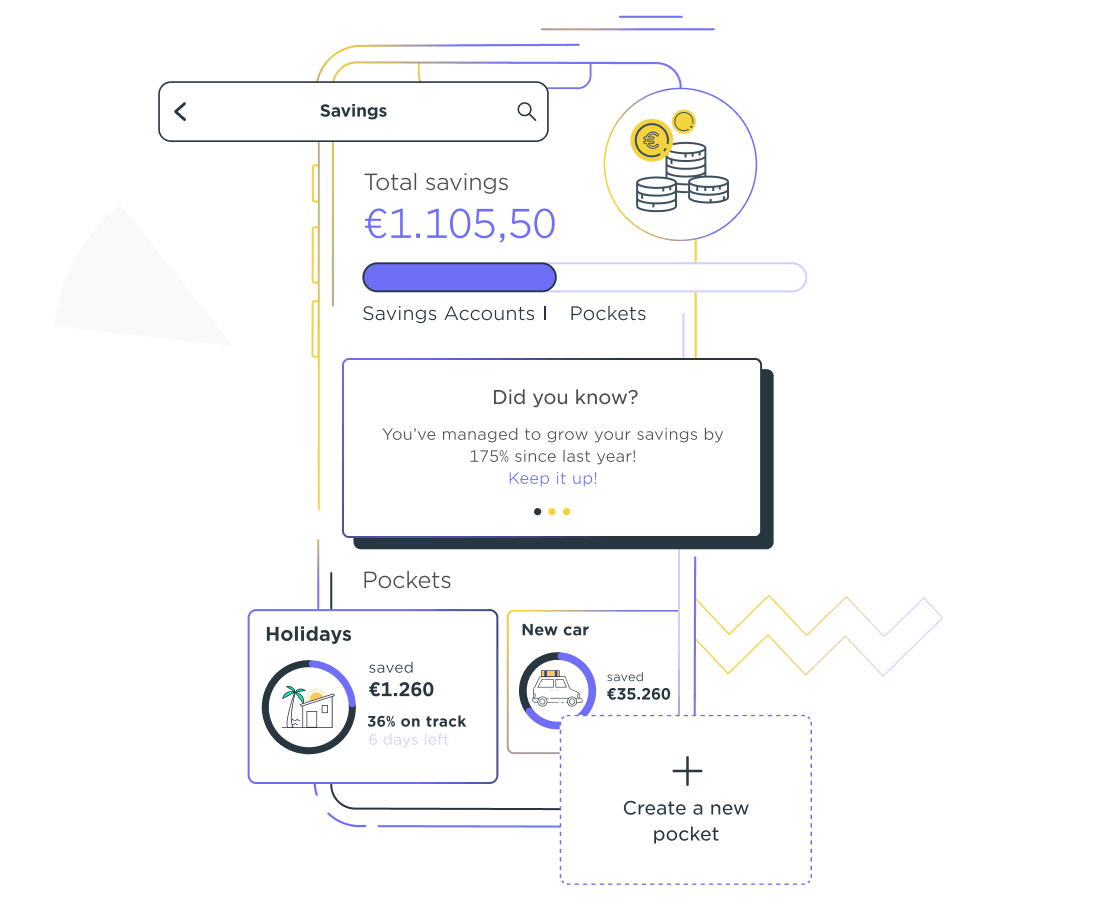

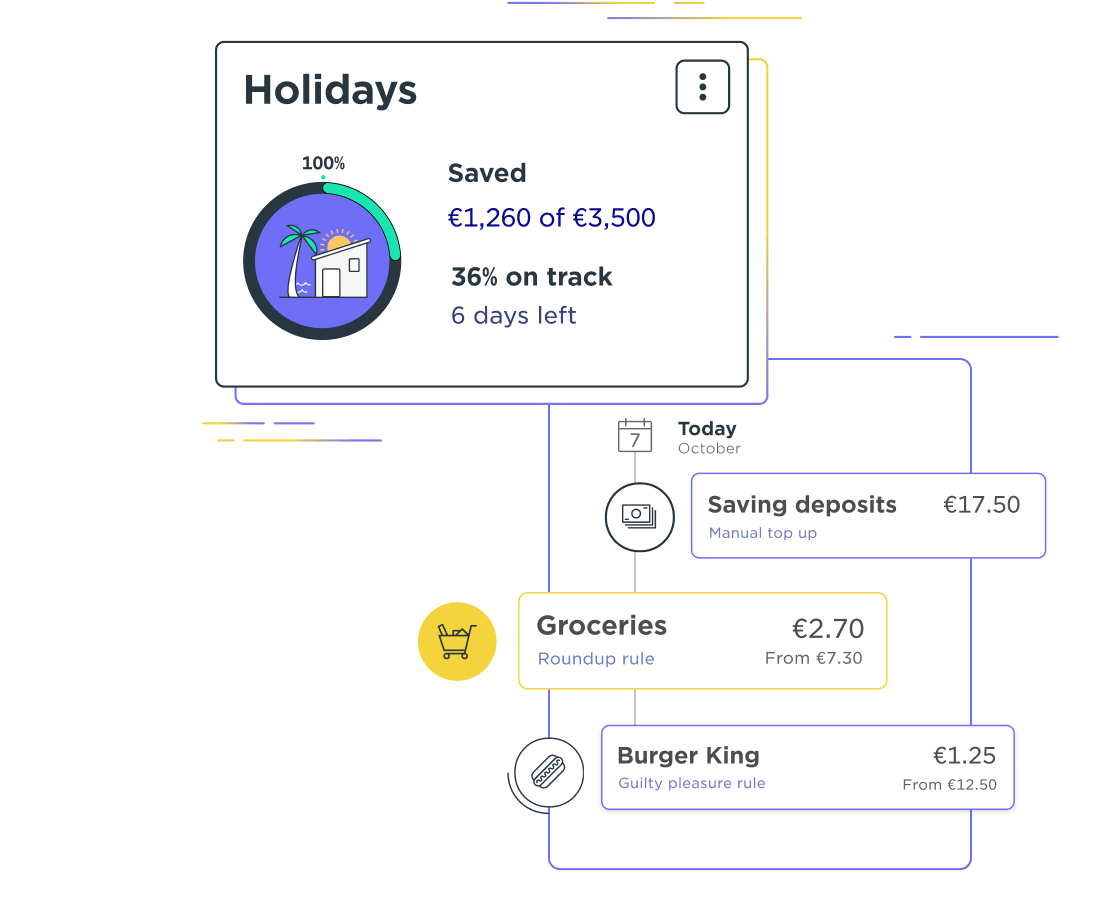

Saving goals

Allow your customers to create pots of savings where they can work towards a specific target such as saving up for a home, a vacation, or a new car.

Customers can add to their pots manually or through a variety of saving rules.

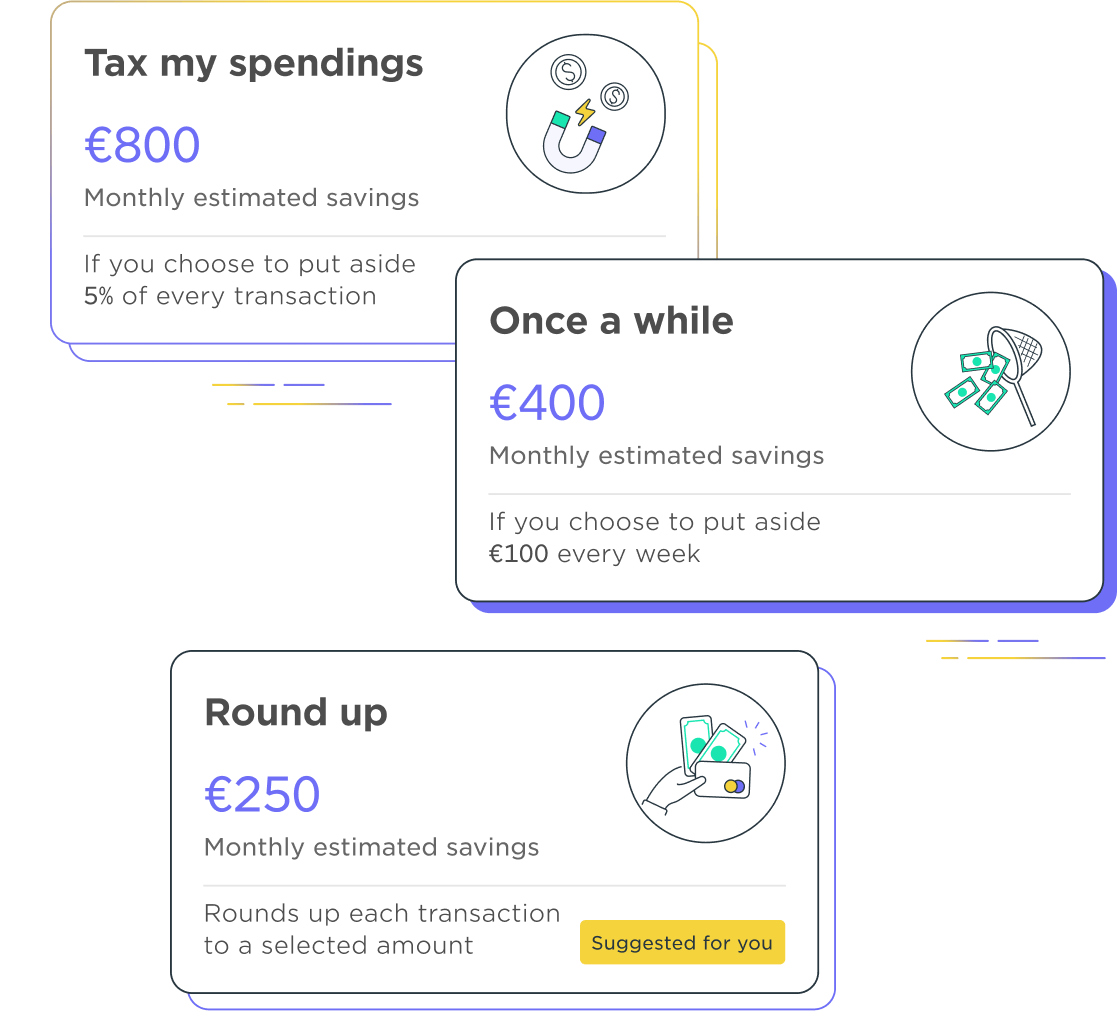

Automated Saving Rules

Provide your customers with gamified rules that seamlessly set money aside, helping them automatically grow their savings.

Meniga offers several rules that customers can choose from, such as:

- Rounding up transactions to the nearest € and transferring the difference to savings

- Taxing the customer’s guilty pleasures

- IFTTT algorithms linked to external events

Nudges & Insights for

Savings

All Meniga Savings modules include out-of-the-box nudges and notifications to help your customers track and monitor their savings progress.

Designed for Customers, Made for Banks

Works with every PMF solution

Powers open banking use cases

Flexible payment initiation integration